THE MOST AND LEAST EXPENSIVE VEHICLES TO INSURE

Make and model make a big difference

Whether you’re looking to save money on your car insurance or thinking about purchasing and insuring a new car, it’s important to remember that there are several factors that play a role in determining your monthly insurance premium. Some models of vehicles are more expensive to insure, while others may cost less due to these factors.

Here is a list of some of the most and least expensive vehicles to insure and some reasons that helped determine why. These vehicle premiums are compared to the national average of $1,682 per year, according to Insure.com.

THE MOST EXPENSIVE

1. Maserati Quattroporte has a 3.0-liter V6 engine or 3.8-liter V8 engine that delivers 345 to 580 horsepower, allowing you to accelerate from 0 to 60 mph in only four seconds. But, it also comes with the highest insurance price tag at an average of $5,176 per year. The cost to replace parts, or the entire vehicle (which cost $96,000 to $143,000, depending on customizations) also play a role in the high insurance cost. The Maserati Quattroporte Modena Q4, starting at $126,000, also runs high at $5,118 per year for insurance.

2. BMW M8 Competition Gran Coupe offers 617 horsepower and includes track-ready cooling systems, a twin scroll bi-turbo, and a dual oil pan. Other intelligence features and the overall cost to purchase—$144,000 and higher—make this vehicle the second most expensive to insure at $4,231 per year.

3.Porsche Panamera Turbo S E-Hybrid Executive is the third most expensive to insure at an average of $4,221 per year, likely due to the twin turbo gas/electric V-8 engine and other luxury features. Even though this vehicle does have several safety features, many insurance companies won’t even insure a high-risk vehicle like this at all, likely requiring the owner to purchase luxury vehicle insurance.

4.Audi RS e-tron GT gives you 637 horsepower and 612 ft.-lbs. of torque, getting you from 0 to 60 mph in as little as 3.1 seconds. The fuel efficiency is outstanding (79 mpg city and 82 mpg highway), but it will cost you about $4,150 annually to insure.

THE LEAST EXPENSIVE

1. Subaru Forester 2.5I Wilderness came in as the least expensive vehicle to insure in 2022, costing around $1,353 per year. The all-terrain accessibility, increased ground clearance, standard symmetrical all-wheel drive, amended drivetrain maximized for climbing, and overall safety ratings help keep the cost down. Plus, the cost to replace parts is lower for this model, and overall, less expensive than almost every other vehicle.

2.Hyundai Venue SE is the second least expensive to insure, with an average annual premium of $1,360. This is likely due to its functionality and cheaper price points, including getting 31 miles to the gallon, a 121 horsepower/1.6-liter DPI 4-cylinder engine, forward collision-avoidance assist with pedestrian detection, lane assist/departure warning, driver attention warning, and other features.

3. Honda CR-V LX moved down one spot from last year and is now the third least expensive, with an average annual premium of $1,366. This vehicle features a variety of advanced safety features that make it less expensive to insure, including forward collision warning, forward automatic emergency braking, road departure mitigation, adaptive cruise control, lane departure warning, and others.

4. Mazda CX-3 dropped three spots this year compared to last year, costing approximately $1,379 on average per year to insure. Adaptive cruise control, lane assist/departure warning, automated emergency braking, and other features help keep the insurance cost down.

5. Toyota C-HR XLE will cost you about $1,384 annually to insure. This vehicle has a predicted reliability score of 80/100 from J.D. Power. It also offers several built-in safety features, such as blind spot monitoring, emergency braking, lane assist/departure warning, forward collision warnings, and more.

OTHER VEHICLE INSURANCE FACTORS

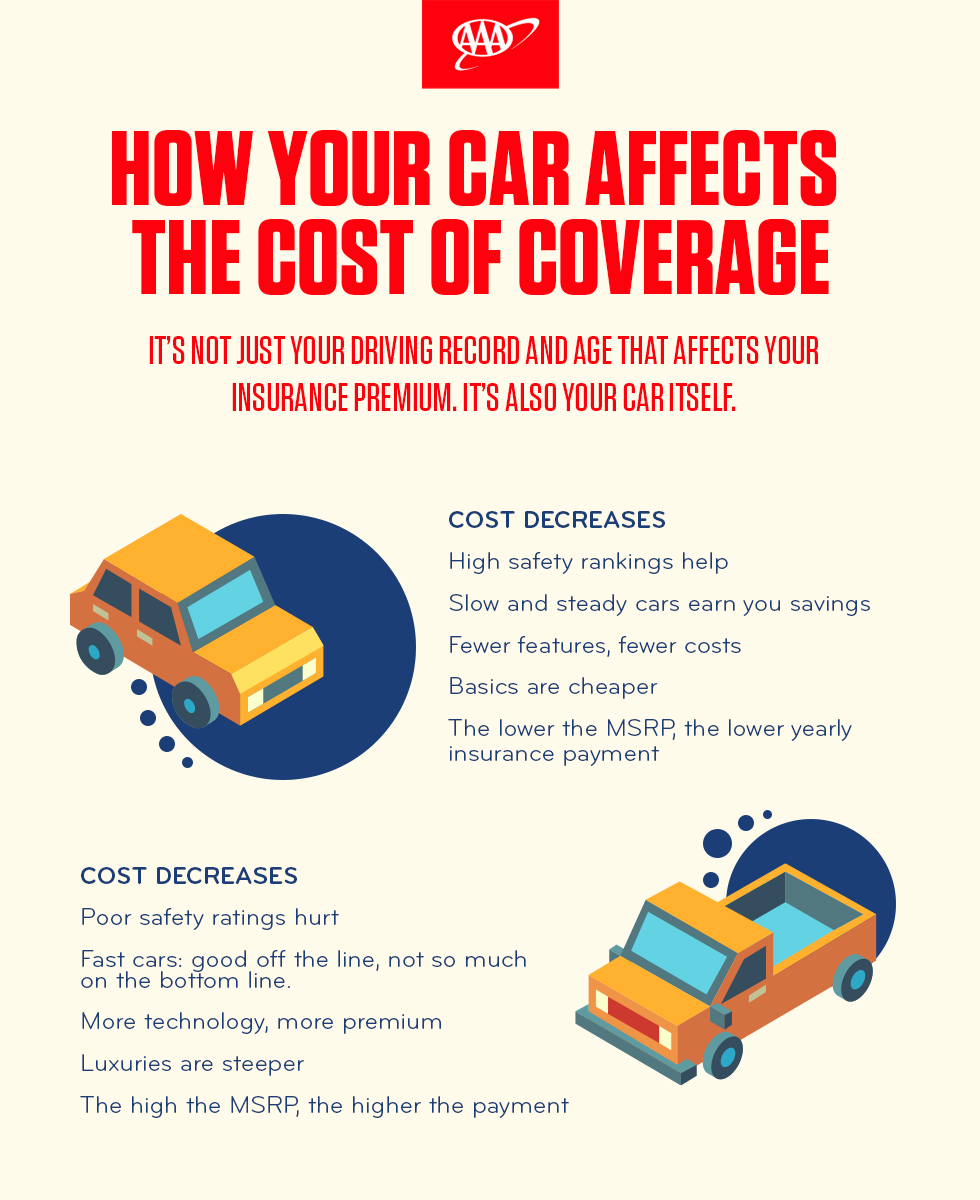

Typically, the more safety features a vehicle has, the lower the annual insurance rate will be. That’s because drivers of these vehicles are less likely to be in an accident, or if they are, there is less likelihood of severe damage or injury, which keeps costs lower for insurance companies.

On the other hand, larger engines and higher speeds can raise insurance rates due to the increased likelihood the driver will drive fast and perhaps be more reckless.

Additionally, insurance companies also consider the cost to repair the vehicle. Sports cars and luxury vehicles typically have a much higher price tag when it comes to materials and repairs, which contributes to the higher insurance rate. This includes the vehicle's interior and exterior, plus the technology within the vehicle.

If a vehicle is damaged or totaled, the insurance company will have to pay for the repair or even the replacement cost of the vehicle. So, the more expensive the vehicle is to purchase, the higher the insurance rate.

When calculating insurance premiums, insurance companies also consider:

- Your driving record

- Where you live

- Your credit score

- Your gender

- Your age

HOW TO SAVE MONEY ON AUTO INSURANCE

Some of the most common ways to save money on auto insurance include:

- Keeping a clean and safe driving record

- Maintaining a good credit score

- Bundling two or more vehicles, or bundling auto and home insurance, with the same insurance company

- Increasing your insurance deductible

- Setting automatic electronic payments for your premium, which sometimes qualifies you for a discount

- Exploring other discount options

- Opting for factory-installed safety features (airbags, anti-lock brakes, anti-theft systems, electronic stability control, forward collision warnings, lane assist/departure warnings)