Nobody looks forward to tax time. From the recordkeeping to the paperwork, it’s a season of stress. But the deadline for 2022, April 18, will be here before we know it. While it’s daunting, nothing adds to the pressure like waiting until the last minute. So, check out this guide to filing income taxes and use it to get a head start.

What do I need before I can start on my taxes?

Everyone’s situation will vary depending on their work and situation. For example, you might want to hire an accountant to help you, while John down the street does his alone. But everyone needs to cover the same bases before they start, like:

- Gather important documents (W-2s, 1099s, etc.)

- Collect any receipts

- Write down personal information (Social Security number, rental property addresses, etc.)

- Find last year’s return

- Plan for a refund

- Potentially file for an extension

What are the different ways I can file my taxes?

There are three ways you can file your taxes:

- Independently. You can download your tax documents, fill them out, and send them along to the IRS. It’s up to you whether you mail the return or submit it electronically. All federal tax forms can be found here, too.

- Hiring a tax preparer. A tax preparer is a professional who can help you file your taxes. This may work best for anyone with a business, side gig, or complicated financial situation.

- Electronically file. With software, you put your own information into the program as it guides you. Some qualifying taxpayers can even get access to free tax preparation software through IRS Free File.

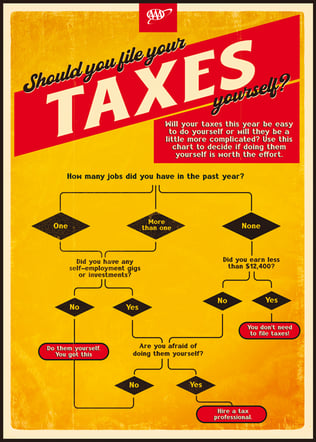

What method of filing my taxes is best for me?

Filing taxes is no walk-in-the-park. But some methods make it easier than others. For example, you may be more likely to make mistakes if you file on your own. That’s why it’s usually better for people with a complicated tax situation to go with professional support. You’re less likely to mess up and cost yourself money.

You may also want to opt for a tax professional if you’re unsure about anything. For example, maybe you never filed taxes before or have new streams of income. In that case, a professional can guide you. They can even help you minimize your tax burden and maximize your deductions.

Tax software offers a middle ground between the other two options. You fill in your own information, but the software helps you along.

What pitfalls do I need to avoid when doing my taxes?

Mistakes are a normal part of life, but it’s important to avoid them during tax time. Any mishaps can delay your tax return for weeks or even months. Not only that, you may face interest or penalties. Some missteps you want to dodge include:

- Failing the basics, like spellings and calculations

- Poor recordkeeping

- Choosing standard deduction automatically

- Not reporting all your income, like bonuses or investments

- Forgetting your state individual healthcare mandate

- Missing out on tax breaks or deductions

- Forgetting deadlines

- Choosing the wrong filing status

What happens if I get audited?

During auditing, the IRS reviews your records and financial accounts. The goal of this is to check if you reported your tax information correctly and according to the law.

The IRS will notify you by letter (and only letter) and give you instructions. Typically, you need to give them specific documents, like previous tax returns. Remember: the IRS requires you to keep all your tax-related documents for a minimum of three years.

Audits can also happen through in-person interviews. This may be necessary if you have too many files to mail. But the timeline varies based on scheduling, the issue’s complexity, and whether you dispute the findings.

There are three ways this can go: the IRS finds nothing wrong, they propose a change you agree to, or they propose a change you disagree with. If you disagree, you can file an appeal, reach out to an appeals officer, or ask for a conference with an IRS manager.