7 Ways to Pay Off Your Loan Debt Faster

Want to clear your debt quickly? Follow the 50/30/20 rule, set up autopay, refinance your loans, and more

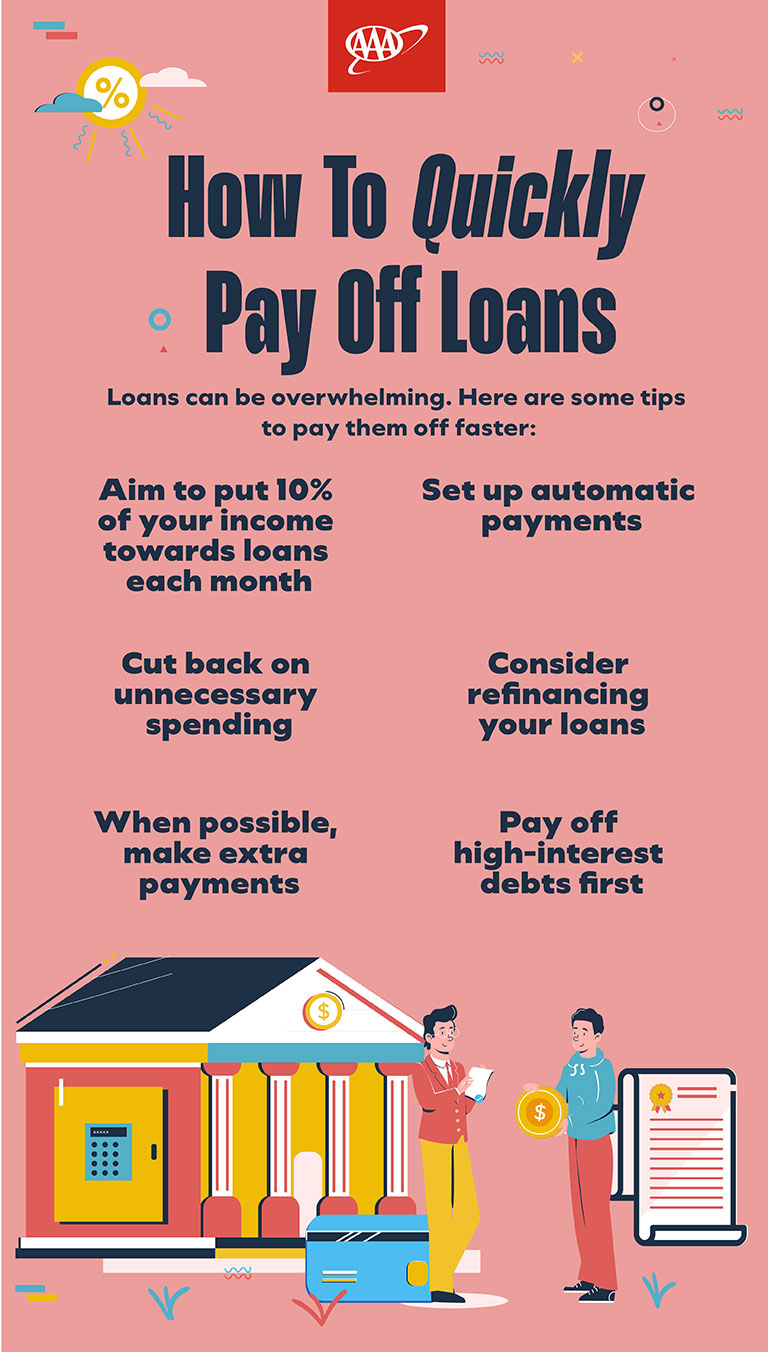

Paying off loans can seem overwhelming, but with the right approach, you can get ahead and pay them off faster. There's no one-size-fits-all solution, but some strategies might work better for you than others. Whether you're looking to lower interest costs or clear your debt quickly, these practical tips can help you pay off your loans quickly.

Create a budget

Creating a budget is a great starting point. While there are many ways to do it, one method worth considering is the 50/30/20 rule. With this approach, you allocate:

- 50% of your income to your needs like mortgage payments, health care, groceries, and debt payments

- 30% to your wants like dining out, shopping, and vacations

- 20% to your savings and extra debt payments

Achieving the perfect 50/30/20 rule split might not always be realistic, and that's okay. Think of this rule as a guideline to help you stay on track. As you create your budget, focus on how much you can put toward your monthly loan payments. This will give you a clearer picture of your overall financial situation and help you manage your debt more effectively.

Cut back on spending

If you want to speed up the loan repayment process, start by taking a closer look at your nonessential spending. Identify areas where you could cut back, like dining out, vacations, or rarely used subscriptions. By eliminating some of these extra costs, you can free up more money to put toward your loan debt.

Make extra payments

Once your budget is set, you can use any extra cash to pay down your debt. There are a few ways to do this, such as:

- Making loan payments every 2 weeks

- Rounding up your monthly payments

- Making extra payments throughout the year

Whatever method you choose, ask your loan servicer to apply those extra payments directly to the principal balance rather than placing your account in a “pay ahead” status. This approach helps you reduce your balance faster and potentially save on interest. Before you start, though, make sure your loan doesn’t have any early payment penalties.

Set up autopay

Many lenders offer the option to set up autopay, which helps you avoid missed payments and late fees. Some even provide discounts for using automatic payments, which can reduce the interest you pay over time.

By lowering your interest and ensuring you never miss a payment, autopay can help you pay off your loan faster and stay on track with your repayment schedule.

Put any extra income towards your debt

Did you recently get a raise, a tax refund, or even win the lottery? While it might be tempting to spend that money on a home renovation or vacation, using it to pay down your loan debt can help you pay it off faster.

Another way to boost your income and earn extra cash is by starting a side hustle. Whether you drive for Uber, walk dogs, or find another gig, there are plenty of ways to make extra cash in your free time.

Putting that extra money toward your debt can significantly reduce the interest you’ll pay over time, helping you get ahead in your repayment journey.

Refinance your loans

Refinancing your loans can be a powerful way to pay off debt faster. When you refinance, you essentially take out a new loan to pay off your existing debt with the proceeds.

Borrowers usually refinance to secure a lower interest rate, qualify for better terms, or make their debt more manageable. If interest rates have dropped since you took out your original loan(s), or if your financial situation and credit score have improved, you might be able to lock in a lower interest rate.

Additionally, you could choose to refinance for a shorter loan term, which would help you pay off the loan more quickly and reduce the extra costs from accrued interest.

Pay off high-interest loans

Often called the avalanche method, paying off high-interest loans first can be a cost-effective way to tackle loan debt.

High-interest loans can be especially costly because the interest builds up faster than on lower-interest debts. This means that even if you’re making regular payments, a big chunk might be going toward interest instead of reducing the principal balance. Over time, this can lead to even more debt as interest keeps adding up.

To tackle this, focus on paying down the loan with the highest interest rate first. Keep making the minimum payments on your other debts, but put any extra money toward the one with the highest interest.

Once that’s paid off, move on to the debt with the next highest interest rate.

Fast-tracking your loan payoff

Paying off debt doesn’t have to be overwhelming. By taking a few steps—like tackling high-interest loans first, making extra payments when you can, or setting up autopay—you’ll be on your way to debt freedom faster than you think.