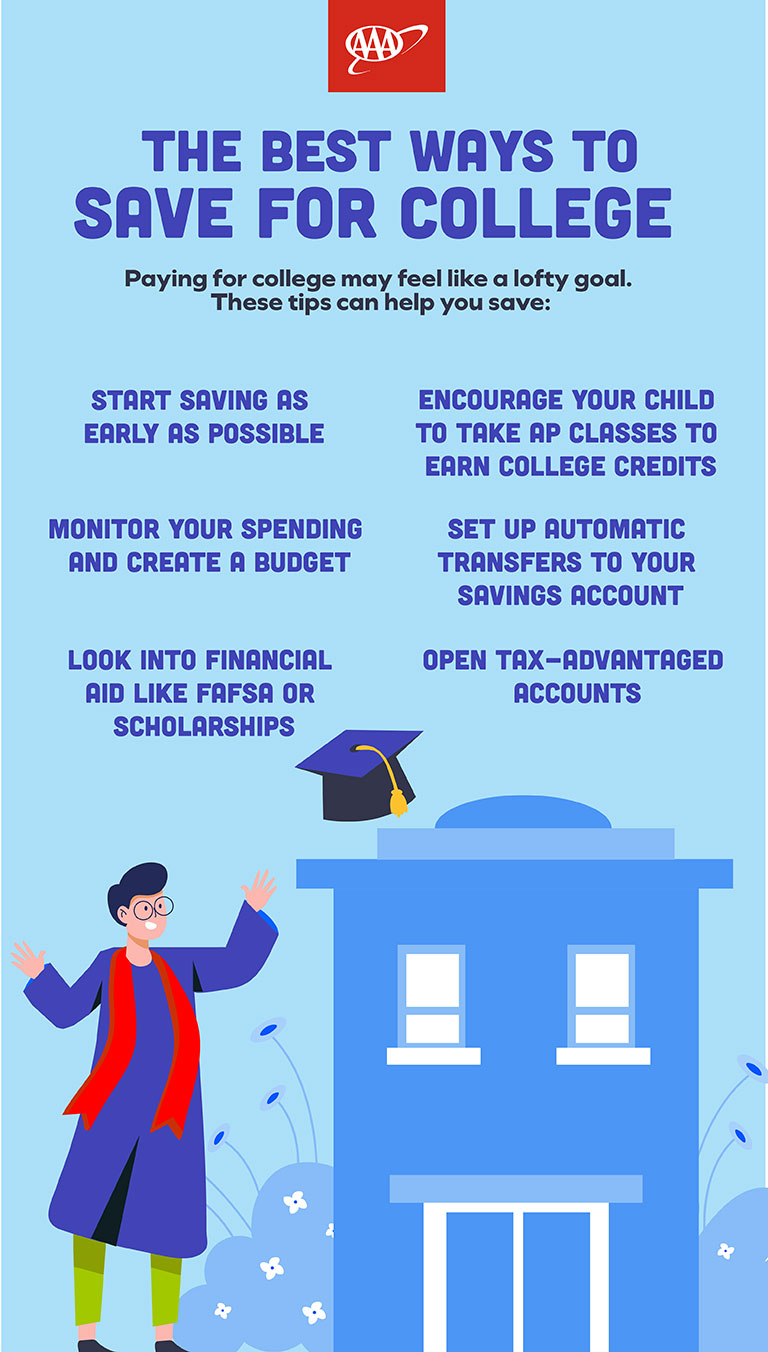

7 Secrets to Saving for College

Take the worry out of paying for college with student financial aid, tax-advantaged accounts, high school AP classes, and more

The thought of covering college costs can be intimidating, especially with tuition rates on the rise. According to recent data from , the average private college tuition for the 2023-2024 academic year hit $42,162. If you're looking at in-state public colleges, the costs are about 75% less. However, out-of-state tuition at public colleges can be more than double that, averaging $23,630 per year. Planning for college expenses can seem overwhelming, but we’re here to help. Keep reading for advice on how to save for college, from student financial aid to tax advantaged accounts, high school AP classes, and more.

Start saving now

When it comes to covering college costs, starting early can really pay off. The sooner you begin saving, the more time your money has to grow, and the less stressed you'll be when those tuition bills start rolling in. There’s no perfect time to start saving for college, but even small amounts saved now can make a big difference later, easing the financial burden when the time comes.

Create a budget

Budgeting is an important part of managing your money, especially if you’re saving for college. Start by keeping track of what you earn and spend each month, including necessities and extras like eating out or vacations. This will help you identify where your money is going and areas you can make changes to save more for college.

Once you understand your spending habits, set aside a specific amount each month for college savings. It doesn’t have to be a big amount—what really counts is being consistent. Also, make sure to check in on your budget regularly to stay on track and make any necessary tweaks.

Leverage tax-advantaged accounts

Opening tax-advantaged accounts can be a good way to start saving for college, especially if tuition is still a few years away. Here are some options you might want to check out.

A 529 plan is a savings account specifically for education expenses that your investment can grow tax-free.

To open a 529 plan, you’ll need the Social Security number (SSN) of the beneficiary, usually the child you’re saving for. The IRS allows you to contribute up to $18,000 per year per child ($36,000 for married couples). Keep in mind that while these plans are state-sponsored, your state might have different contribution limits. It’s a good idea to do some research to find the best option for your situation.

ESAs work a lot like 529 plans—they let your savings grow tax-free, and you can withdraw the money for educational expenses without having to pay taxes on it. However, there are some key differences. For example, you can only contribute up to $2,000 per year per child.

UGMA/UTMA accounts are another type of savings account where parents or others can put money aside for a child. The earnings are usually taxed at the child’s lower tax rate, which can make it a smart way to save for future college costs.

Encourage your student to take AP classes

Advanced Placement (AP) courses give high school students a chance to earn college credits by passing the corresponding AP exams. Excelling in these classes can help reduce the number of courses a student needs to take in college, saving both time and money on tuition.

Plus, AP courses help students adjust to the demands of college-level work, making the transition to college life a bit easier.

Automate your savings

One helpful savings strategy is to set up automatic transfers from your checking account to a college savings account. You might also want to consider directing a portion of your paycheck into a college savings account before it even hits your checking account.

By automating your savings, you remove the hassle of manual transfers and ensure you're consistently contributing. This approach is perfect for anyone who finds it challenging to stick to their savings goals.

Get your children involved

Getting your kids involved in saving for college is a good way to teach them important financial skills and give them a sense of ownership over the goal. You can lead by example by showing them how much you’re contributing to their college fund and even offering to match what they save.

It’s also a good idea to help your child set financial goals that make sense for their age. This will look different for every family, but some goals might include things like setting aside part of any money gifts they receive into their college savings account.

Look into other financial aid options

When it comes to paying for college, there are other resources available to help lighten the financial load. From scholarships to federal student financial aid and various savings plans, taking the time to explore your options can significantly ease the financial burden.

There are many scholarships out there, ranging from merit-based and need-based to specialized opportunities. Websites like Scholarships.com and Fast Web can connect you with the right scholarships, simplifying your search for college funding.

Filling out the Free Application for Federal Student Aid (FAFSA) helps you build a financial aid package tailored to your needs. This can include federal grants, loans, and work-study programs, all of which can significantly reduce your out-of-pocket costs. Just remember to apply as you get closer to starting school, and keep in mind that the amount of aid you receive usually depends on your eligibility and the type of assistance you qualify for.

College is undeniably expensive, but with some planning and by taking advantage of tax benefits and student financial aid options, you can make the process more affordable and less stressful.