Should You Buy Now, Pay Later?

How buy now, pay later plans work—plus, the pros and cons of using these installment options

Buy now, pay later (BNPL) services are nothing new, but they have been gaining in popularity since 2010 with the rise in digital payments, helping people spread out payments for online and in-store shopping. In fact, it’s estimated that more than 93 million Americans will use a BNPL at some point.

What is buy now, pay later?

BNPL services let you break up your payments over time, making big purchases feel easier on your wallet. Many plans offer no-interest options, but you must pay on time. If you miss a payment and incur extra fees, those charges can add up fast. So, before you jump in, make sure you know how this type of installment payment plan works, and weigh the pros and cons to avoid spending more than you planned for an item.

With BNPL, you can spread out your purchase into smaller, more manageable chunks. For example, a $200 purchase might be divided into four monthly payments of $50.

How does buy now, pay later work?

Many retailers partner with BNPL service providers. You may, for example, purchase furniture, clothing, electronics and more through BNPL. Your first payment is typically due at checkout, with the balance spread out in equal installments over a specified period. For example, paying in four equal installments is a popular plan. Some of the most familiar BNPL service providers include Klarna, Afterpay, Affirm, and PayPal.

Application for BNPL usually occurs at the point of sale, with an approval decision prior to checkout. While you don’t need a specific minimum credit score to use many BNPL services, some might conduct a soft check to see your credit history. (Soft checks typically don’t affect your credit score.)

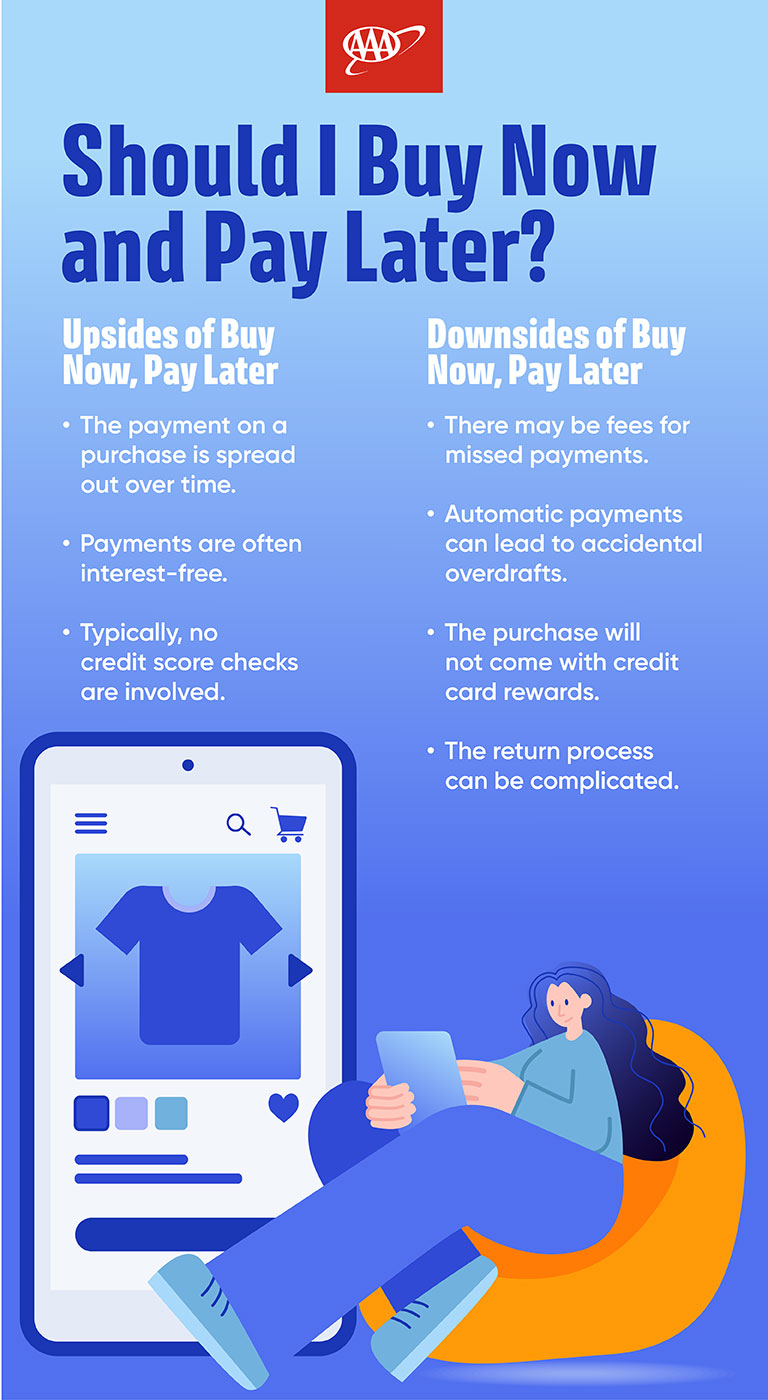

The pros of buy now, pay later

Here are a few reasons why BNPL could be a good fit for your next purchase.

Manageable payments

BNPL lets you break up a big purchase into smaller, more manageable payments, so you don’t need all the money upfront. Most services split the cost into payments spaced two to four weeks apart, often aligning with biweekly paychecks.

Interest-free payments

Many BNPL options don’t charge interest, making them appealing if you want to spread out your payments without extra costs.

No credit check

Some BNPL providers skip the credit check, which can be helpful if you’re new to building credit or trying to improve your score.

Cons of buy now, pay later

While BNPL services can make purchases easier to manage, there are also some downsides.

Fees and interest

If you miss a payment, you could get hit with late fees or interest charges that add up fast. If you stop paying completely, your account could go to collections, which may pile on even more fees and extra interest. Plus, it could cause a drop in your credit score.

Overdraft risk

Those automatic BNPL payments can sneak up on you and cause overdrafts if you’re not careful. So, keep track of your payment dates, and make sure you have enough money in your account after each paycheck to avoid any unwelcome surprises.

Losing out on rewards

Choosing BNPL over a credit card could mean giving up rewards like points, cash back, or purchase protection. Sure, you could pay your BNPL bill with a credit card, but it can get complicated and end up costing you more if you don’t pay off your balance.

Complicated returns

Returning something bought with BNPL isn’t always a smooth process. You may still have to make payments while waiting for a refund. And, if you get store credit or cash back, you'll still need to keep paying until the purchase is repaid in full.

How to avoid common buy now, pay later traps

Using BNPL services can be super tempting, especially since these services are usually simple to use. But there are a few common traps to watch out for.

Overextending your finances

BNPL companies usually don’t report your payments to credit bureaus, so lenders might not see all your debt when you apply for new credit. This could mean getting approved for more credit than you can afford. So, always double-check your budget before you hit "buy."

Getting caught in a debt cycle

It’s easy to lose track of how much you’re spending with BNPL. Without careful budgeting, you could end up with more debt than you can manage.

Risk of fraud

The simple sign-up process for BNPL services can make them a target for scammers. Thieves can take over your account with stolen details and go on a shopping spree in your name. Protect yourself by using strong, unique passwords and keeping an eye on your transactions for any unusual activity.

So, should you use a buy now, pay later service? It really depends on your situation. While these services can be helpful, they do require some planning and self-discipline. If you choose to use one, make sure you stay on top of your payments, keep enough money in your account, and understand the total cost of this convenience.