How to Protect Your Identity

Safeguarding your identity from thieves begins with peace-of-mind identity theft protection

Identity theft is on the rise and can happen to anyone at any time. The FTC received an alarming 5.7 million fraud and identity theft reports last year. With identity theft becoming increasingly widespread and cybercriminals becoming increasingly sophisticated, it’s more important than ever to keep your personal information safe.

So, how do you protect yourself? One simple way is to sign up for an identity theft protection service. Here’s what to know.

What is identity theft protection?

Identity theft protection services, like ProtectMyID from Experian, are all about keeping your personal information and finances safe. (ProtectMyID Essential is a free benefit with AAA membership.) For a monthly or annual fee, these companies monitor your credit and scan the internet, including the dark web, for signs of malicious activities. They’ll alert you if anything seems suspicious, helping you prevent issues before they arise. If someone does steal your identity, an identity theft protection service can help you monitor and resolve the situation.

How does identity theft protection work?

While each company may offer different features, here’s a breakdown of how the common features usually work.

Identity monitoring

This feature tracks personal information beyond just credit data, such as Social Security Numbers and appearances in public records, including the dark web. So, when a thief attempts to use your personal information, the identity protection service can flag it and alert you.

Credit monitoring

Credit monitoring keeps an eye on activity across all three credit bureaus—Experian, Equifax, and TransUnion—watching for changes in your credit score. It also helps detect newly opened accounts that shouldn't be there. The goal is to catch issues such as a new line of credit taken out in your name before the fraud escalates.

Identity recovery

If your identity is stolen, identity recovery services can help fix the problem. Identity recovery services can handle tasks like setting up fraud alerts, filing reports with the FTC and the police, and mediating with creditors.

Identity theft insurance

Identity theft insurance reimburses you for expenses related to identity theft (excluding stolen money). It can cover costs such as credit reports, legal fees, and lost income due to identity theft incidents. Coverages typically range anywhere from $10,000 to $1 million.

Tips for protecting your identity

Protecting your identity is critical, but it doesn't have to be stressful. Along with using an identity theft protection service, you can take some simple steps to keep your identity safe.

Monitor your accounts

Reviewing your bank and credit card statements regularly can help you quickly spot any unauthorized purchases or suspicious activity. This way, you can act fast and minimize any potential damage.

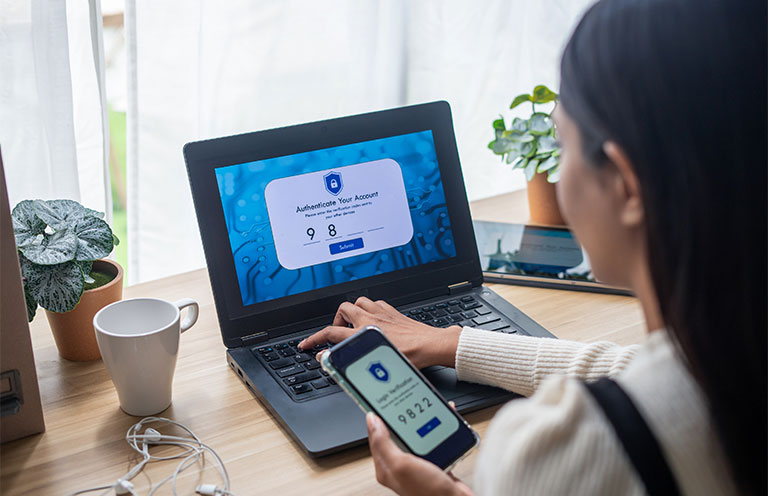

Create strong passwords

Creating complex passwords with a mix of letters, numbers, and special characters can make it more challenging for impostors to access your account information. It’s best to update them periodically to keep your online accounts secure.

Shred personal documents

Before tossing out documents with sensitive information, such as bank statements and bills, use a shredder. Shredding your documents helps prevent dumpster divers from easily accessing your personal details.

Practice internet safety

Avoid clicking on suspicious links in emails or messages, and don't share personal information on unsecured websites. This helps you avoid phishing scams and data breaches. Remember that if you think something seems suspicious, it probably is.

Freeze your credit

Placing a credit freeze can help prevent thieves from accessing your credit. It essentially stops anyone—caveat: including you—from opening new accounts in your name. This makes it much harder for identity thieves to open new accounts or loans without your knowledge.

Limit personal information

Be careful about what personal details you share on social media and other online platforms. Sharing too much personal information can increase the risk of identity theft because criminals can use it to trick you or steal your data.

Check your credit report

Regularly checking in on your credit report can help you spot any unusual or suspicious activity. If you see something out of the ordinary, like a new account you didn’t open, make sure to act right away. (Visit the Consumer Protection Bureau’s website to learn more.)

Be aware of scams

Fraudsters will try anything to steal your personal info, including pretending to be your bank. Stay informed about common scams and phishing tactics to outsmart these internet criminals. The FBI offers resources to help you know what to look for and how to protect your personal information.

. . . .

By following these simple and smart tips along with using an identity theft protection service, you can significantly reduce your risk of identity theft, saving yourself time, money and stress.