6 Common Tax Scams To Avoid This Tax Season

How to recognize a scam—tax scams, irs tax scams, and more common cons to guard against

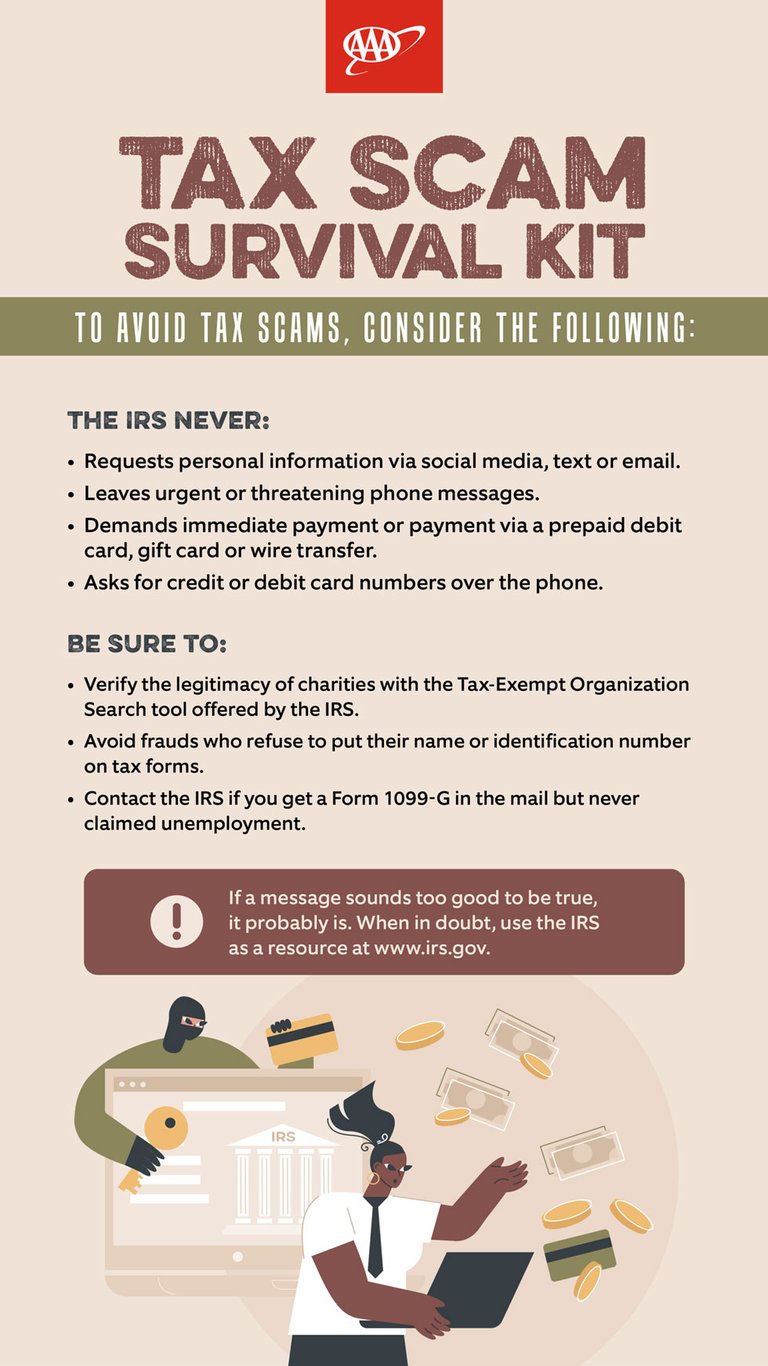

Each year the IRS creates a "Dirty Dozen" list to inform taxpayers of the most common scams. While scam activity occurs all year round, fraudulent activity increases during tax season. To safeguard your personal information and your wallet, be vigilant and when necessary, turn to the IRS for guidance.

Method of communication

The IRS "will not send taxpayers messages via social media platforms." The IRS also "does not use text messages to discuss personal tax issues," and "does not initiate contact with taxpayers by email to request personal information."

While you may safely engage with the IRS via telephone, the IRS "does not leave prerecorded, urgent, or threatening messages." For example, common phone scams convey a threat of an arrest warrant or revoking of a license. Remember, these calls are not from the IRS.

Method of payment

You should only pay the IRS online at http://www.irs.gov/payments or by writing a check to the U.S. Treasury. The IRS never accepts "a prepaid debit card, gift card, or wire transfer" as payment and "does not take credit or debit card numbers over the phone."

Furthermore, the IRS never demands immediate payment. Taxpayers always have "the opportunity to question or appeal the amount owed."

Fake charities

As the standard deduction continues to increase, you may search for new charities so you can make tax-deductible donations. Before donating, always ensure the charity is real. Scammers can either impersonate an actual charity or create a fake charity.

One way to play it safe is to search for the charity on the IRS website. First, get the charity's address, full name, and tax ID number. Then go to the IRS website and use the free, Tax-Exempt Organization Search tool at http://www.irs.gov/charities-and-nonprofits to verify the charity's legitimacy.

Just as with paying the IRS, be on the lookout for requests for unusual payment methods from charities. For example, charities don't pressure donors to donate immediately, nor do they ask for payment through gift cards or wire transfers.

Sketchy preparers

If you've had someone prepare your taxes but refuse to place their name and Preparer Tax Identification Number on the return, they are breaking the law, and you should find a new preparer. Such preparers are referred to as ghost preparers.

This illegal action often goes hand in hand with the promise of an unusually high refund, especially when the preparer's fees are based on the refund amount. Other potentially suspicious behavior includes a request to have the refund initially routed to the preparer's bank account, or if the preparer requires a cash payment for their services.

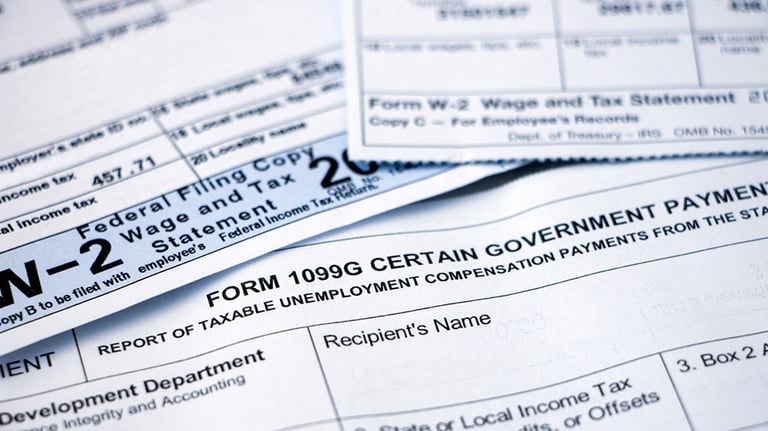

Covid-19 assistance programs

The pandemic may be over, but the scams and the fallout stemming from COVID-19 relief measures continue in 2023. Before handing over tax documents you've received in the mail to your tax preparer, look through them for a Form 1099-G. If you received a 1099-G reporting unemployment compensation but you never claimed unemployment or received any funds, a scammer likely filed a claim for unemployment using your information.

Take corrective action by reporting the fraud to the state that issued the 1099-G. Ask about their process for obtaining a corrected form.

Useful tips

If you receive a communication—whether by phone, email, or letter—that sounds too good to be true, it probably isn't legitimate. If you need to confirm you're communicating with the IRS, look up its phone number instead of calling a number you were given. Visit http://www.irs.gov/help/telephone-assistance for a list of IRS numbers.