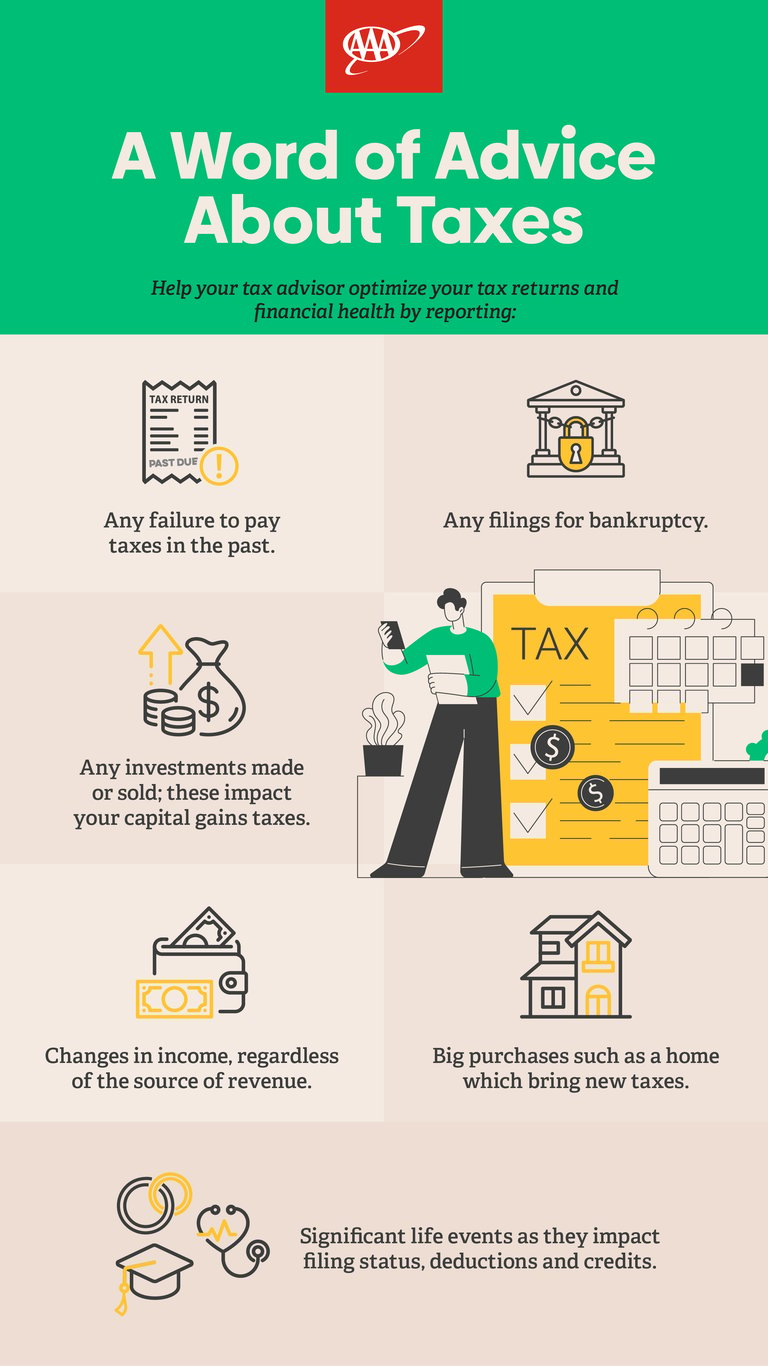

6 Life Events to Share with Your Tax Preparer

Alerting your tax advisor and careful tax planning can optimize your tax return

Managing your finances involves more than just tracking income and expenses; it's about understanding how major life events and financial decisions impact your taxes. The six areas below are essential to discuss with your tax advisor to ensure accurate and strategic tax planning. Remember, transparency with your tax professional leads to optimized tax returns and financial well-being. Here are the details of each crucial aspect.

Change in income

Did you start a side hustle this year or get a raise at work? Telling your tax advisor about these changes upfront can streamline the accounting process. Your income level determines your tax rates and affects eligibility for certain tax advantages (such as the Earned Income Tax Credit), so getting this number right is vital.

As a result, your tax advisor should know about any significant changes in your income. For example, include increases or decreases in salary, bonuses, freelance income, rental income, or any other sources of revenue.

Remember, some forms of income don’t increase your taxes, such as inheritances, life insurance proceeds, and Roth IRA distributions. That being said, it’s advisable to share all your income to ensure you don’t miss anything in reporting. For instance, if your inheritance produces a return (such as capital gains) after you receive it, those earnings are taxable.

Buying or selling investment

The timing of investment transactions determines what kinds of capital gains you trigger. Specifically, selling investments before owning them for less than a year incurs short-term capital gains taxes, which are the same as standard income taxes. On the other hand, selling investments after holding them for a year or more incurs long-term capital gains taxes, which are usually lower than short-term capital gains.

So, buying an asset puts you on the clock for long-term capital gains. If you can delay selling it for one year, you'll reduce your tax burden. However, offloading it before then might help you optimize the investment. In either case, it's crucial to keep accurate records and inform your tax professional about the sale. Investments include stocks, bonds, real estate, cryptocurrency, and vehicles.

Significant life events

Life events like marriage, divorce, childbirth, or death in the family can have tax implications. These events may affect your filing status, deductions, and credits. For example, the Child and Dependent Care Credit may apply if you paid for childcare, but not if you're divorced and don't claim the child as a dependent.In addition, moving can have significant tax consequences because every state has different tax regulations. Plus, the IRS, your employer, your bank, and other financial institutions need to know where to send correspondence. Missing a crucial tax document can cause delays or errors in filing.

Failing to pay your taxes in the past

No matter the situation, consistently filing your taxes every year is essential for your financial well-being. Not filing can mean losing a refund from the IRS if it's older than three years, and unpaid taxes accrue penalty fees the longer they sit. Even worse, the IRS can garnish your wages or seize assets to recover the back taxes.

Therefore, if you haven't paid taxes in the past or have outstanding tax issues, it's critical to disclose this to your tax advisor. They can advocate on your behalf to the IRS and negotiate a lower tax bill for unpaid balances. This way, you can fix the issues, minimize the damage, and move forward.

Big purchases

Giant expenditures usually have significant tax implications. For example, buying a home means paying property taxes, which are deductible if you itemize your deductions. In addition, a transaction worth hundreds of thousands, such as a boat, incurs sales taxes. You can deduct these if you don't deduct state income taxes. Therefore, providing a thorough accounting of your purchases over the last year enables your tax preparer to determine which combination of deductions gives you the most advantages.

Filing for bankruptcy

Filing for bankruptcy might not be your most glorious moment, but it has massive tax consequences that are dangerous to ignore. For example, getting a creditor to discharge a debt without declaring bankruptcy means the debt counts as income when you file. On the other hand, if your bankruptcy resulted in discharged debts, the amount doesn't count as income. As a result, not disclosing a bankruptcy could mean paying more taxes than you owe.