Maybe for you, it's a stand mixer. Perhaps it's a smart television. Whatever it is, it's been on your wish list or in your shopping cart for months now. With Black Friday, Small Business Saturday, and Cyber Monday coming up fast, it may be possible to grab a great deal on your wish list items. To keep your prize within reach, budget for large purchases by following these simple tips all year long.

Automatic savings

Some banks offer specific accounts, often referred to as Christmas or holiday club accounts, to help make transferring into your savings account easy throughout the year. To further encourage saving, some banks only allow withdrawals in person.

If your bank doesn't have this specific program, create the concept yourself. Open a separate account and have a fixed amount of money transferred automatically every two weeks. If opening your own account, pay attention to monthly maintenance fees that may be triggered by falling below a minimum balance requirement.

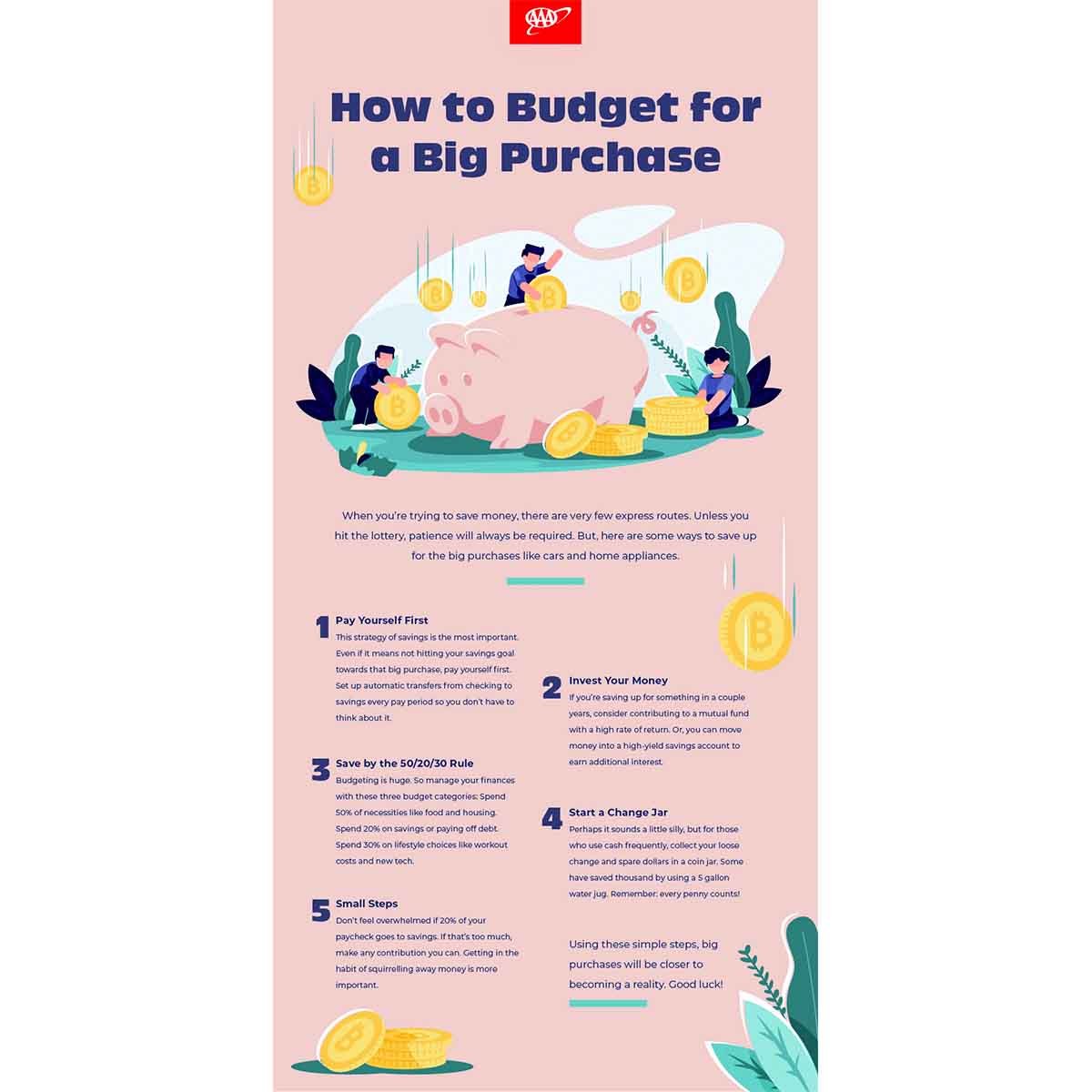

The 50/20/30 Budget rule

This rule calls for dividing your after-tax earnings across three categories: needs, wants, and savings. Savings, associated with the 20% in this rule, refers to paying down debt and saving for retirement. That leaves 50% for immediate needs like groceries and housing costs, and 30% for wants. Wants encompass everything from concert tickets to home decor. It's within this 30% where you could specifically allocate money towards a holiday shopping budget.

Earmark extra earnings

If you have a side job, you could decide that 100% of the money earned from that job will fund your big purchase. Or you could temporarily pick up a side job like driving for a ride-sharing app when you have spare time or take on a seasonal retail position.

Other extra earnings that you could earmark towards your big purchase include gifts you receive from others, money earned working overtime, the commission portion of your paycheck, or an annual bonus from work.

Long-term big purchases

If you don't plan on pulling the trigger on your big purchase in the near term, investing is another savings option available to you. Because the markets rise and fall, investing is typically ill-advised if you need the funds within fewer than five years.

If your goal surpasses that timeframe, you might invest your money in moderate-risk mutual funds or exchange-traded funds (EFTs). Using these investment options can potentially help you reach your goal faster and require less of your actual money, if the investment strategy is right for your personal situation.