Many Americans know the anxiety of missing money, whether it’s waiting on a pension check or even just losing a $20 bill in the back of their car. You may be one of the citizens experiencing this on a much larger scale if you have unclaimed money waiting for you. Here are a few places to look for those assets and starting points in your search to reclaim them.

Unclaimed money from the government

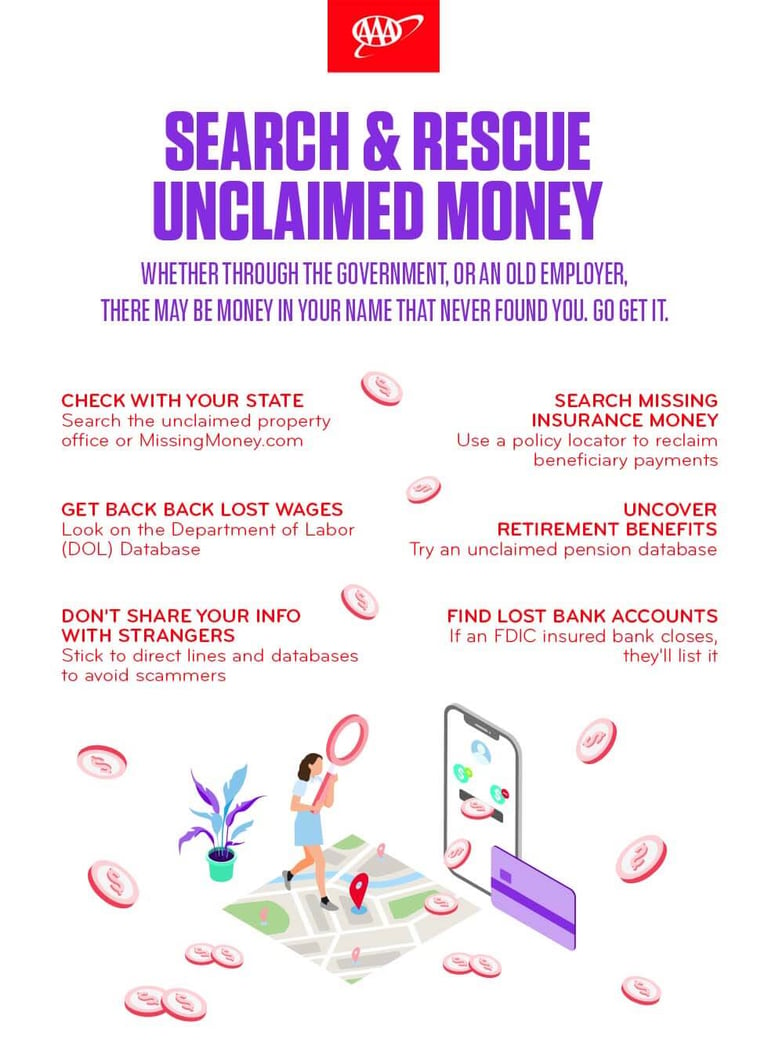

There isn’t one place where you can find all unclaimed government money. So, you’ll have to narrow your search. You’ll need to figure out what type of payment might be involved when you possibly expected the payment and the form it was supposed to come in. However, there isn’t just one contact for unclaimed money from the government. You have to contact the specific agency involved to help assists you.

Some examples of the unclaimed property could be a bank account from an FDIC insured bank that closed or a matured savings bond.

Unclaimed money from your state

States are sent unclaimed money every year from businesses that can’t track down the rightful owner. Those groups or services send the funds to a state-run unclaimed property office. According to the National Association of Unclaimed Property Administrators, states return over three billion dollars every year, and it’s worth it to check if you need to start digging for unclaimed assets.

You can start your search at your state’s unclaimed property office. If that doesn’t work, you can look at the database, MissingMoney.com, which most states participate in or attend outreach events.

Unclaimed money from insurance companies

A loved one might have passed on but didn’t tell you that you’re named on their life insurance policy. While insurance companies try to look for beneficiaries, they aren’t always successful. To find out if you’re one, you’ll need the personal information of the deceased. Afterward, you have a few ways to track down the insurance, including searching for policy paperwork, speaking to the deceased’s financial professional, using a policy locator, searching unclaimed property databases.

Other possible areas are VA Life Insurance funds or FHA-Insurances Refunds.

Unclaimed money from financial institutions

Every year you file taxes, but the IRS may owe you money if you never received your refund. Other financial institutions responsible for banking and investments might have similarly failed to send on the appropriate funds. For example, if a bank or credit union failed, there might be unclaimed funds waiting for you.

You can search databases and listings to see if an institution you worked with shut down. Each type will have different methods to claim any assets you believe are owed.

Unclaimed money from employers

You may have unpaid wages from a current or former employer. If that employer broke labor laws, the Department of Labor (DOL) might be able to recover those wages. Search the DOL database to check. However, they only leave them posted for up to three years.

Unclaimed money from pension or retirement benefits

Similar to unpaid wages, you may have pension or retirement benefits that went unclaimed. This might be because the employer ended that pension or plan or even went out of business. If that applies to you, you can use resources like Pension Benefit Guaranty Corporation’s unclaimed pension database.

Staying safe in your search

Claiming your money should be a free process. So, be wary of companies or individuals who offer to collect your funds for a fee. However, there might be a rare case that asks you to hire a third-party service. If so, you’ll likely pay 10% to 20% of the total collection’s value, though avoid groups who ask you to pay upfront.

There are also scam artists who will pretend to be those institutions or work for groups that deal with unclaimed money. If someone calls you to promise you money from an inheritance or emails you about a floating IRS refund, ignore them. Avoid sharing your information with strangers when you have databases and direct lines you can call.