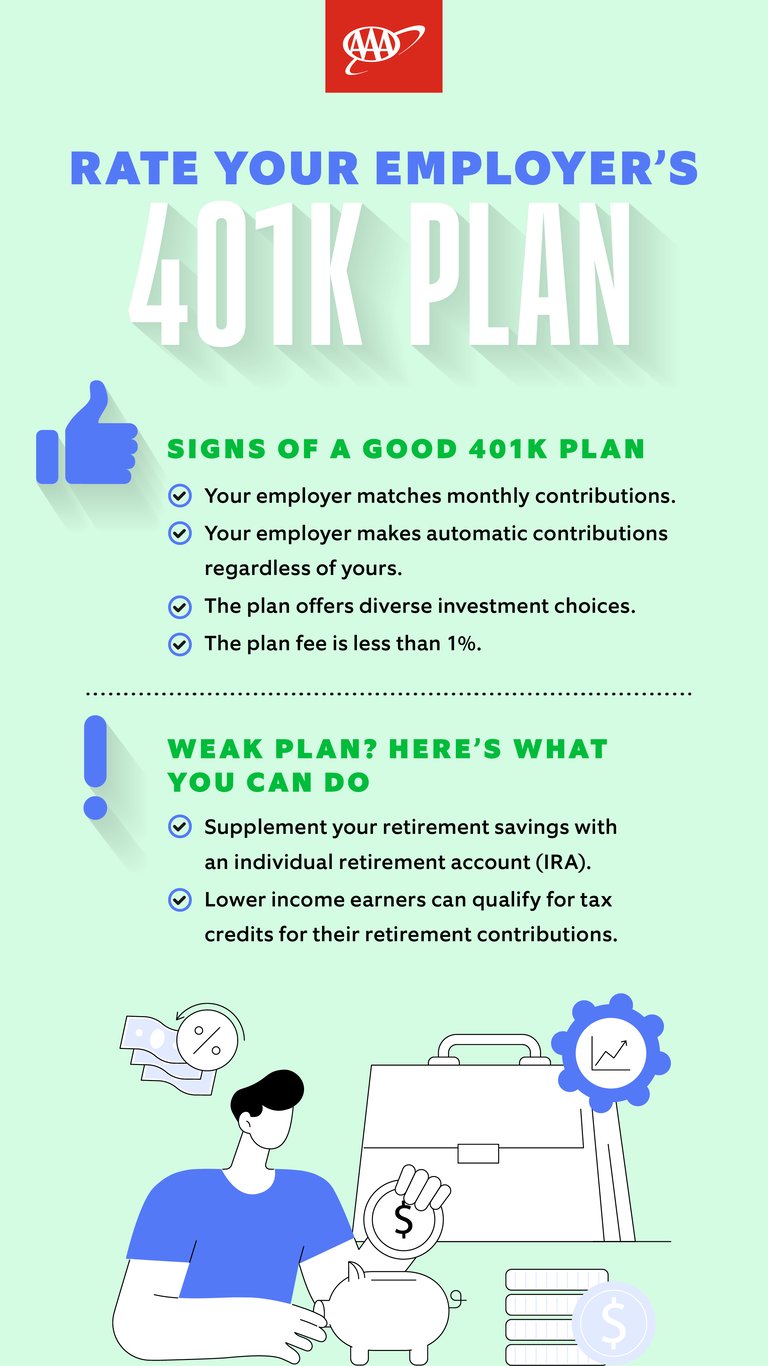

Is My Employer's 401k Actually Good?

Help secure your financial future by determining if your company's 401k is good, and if not, how to supplement your employer's 401k

Securing your financial future is the essence of retirement planning. The question is, will your employer’s 401(k) play a part? Because not all 401(k)s are created equal, it’s vital to explore the facets of each plan to see if they’re worth the time, trouble, and hard-earned money. Here’s how to tell if your workplace’s 401(k) is a solid choice and how you can supplement your retirement savings if the plan doesn’t fit your needs.

How to tell if your company’s 401k plan is good

Assessing the quality of your employer's 401(k) plan is crucial for deciding to contribute to it and improve your financial well-being. Here are several factors to consider when evaluating the effectiveness and value of your employer's plan:

Matching contributions

Most employers match some or all your 401(k) contributions. For example, your employer might match up to 50% of your contributions each year. So, your $5,000 annual contribution to your plan becomes $7,500, enhancing your investment. This feature is an excellent way to boost your portfolio and increase returns.

Automatic contributions

On the other hand, your employer might deposit cash in your account regardless of your activity. So, you could ignore your 401(k) and receive thousands of dollars in the account each year. This way, you could use the money in your paycheck to invest in a different retirement account or pay off debt. Therefore, automatic contributions are an effortless way to diversify your assets.

Investment choices

Evaluating the range and quality of investment options available within the plan is vital before pouring dollars into it. A worthwhile 401(k) program typically provides diverse investment choices, including low-cost index funds, mutual funds, and target-date funds. Access to a variety of investment options allows you to customize your portfolio to your preferences and goals.

Fees

Review the plan's fees and expenses associated with investment options. High fees can eat into your investment returns over time. Look for low-cost investment options with expense ratios competitive with industry standards. Remember, plans from giant employers usually have lower administration fees because the company can spread them over more employees. Generally, if your plan's fees are 1% or higher, look elsewhere for a cost-effective retirement savings vehicle such as an IRA.

If your 401(K) isn’t strong: here’s how to supplement your retirement savings

If your 401(k) is rife with issues, you can save for retirement with different tools. Here are the options to consider:

Consider a traditional IRA or Roth IRA

An Individual Retirement Account (IRA) is a personal retirement savings account that provides tax advantages. For 2023, you can contribute up to $6,500 annually to an IRA ($1,000 extra if you're 50 years or older). Annually investing this amount establishes a solid foundation for your savings. Before opening an IRA, it's essential to consider which type suits you best:

- Traditional IRA: This account type provides an upfront tax deduction for your contributions. While potential earnings grow tax-deferred, you'll incur ordinary income taxes when you withdraw the funds. In addition, if you withdraw money before the age of 59½, you'll experience a 10% penalty, underscoring the value of leaving the money in the account until retirement.

- Roth IRA: A Roth IRA doesn't provide an upfront tax deduction, but you can make tax-free withdrawals of potential earnings once you reach age 59½, provided you've held the account for at least five years. This feature is advantageous if you anticipate being in a higher tax bracket in the future. If you withdraw earnings before 59½, a 10% penalty may apply, but there's no penalty for withdrawing the amount you initially contributed. Contributing to a Roth IRA is subject to certain income limitations. Specifically, in 2023, married individuals filing jointly can make a full contribution if their Modified Adjusted Gross Income (MAGI) is less than $228,000 ($153,000 for single filers). Therefore, a Roth IRA can be a favorable choice if you meet the income limits and don't require an upfront tax deduction.

Automate savings

Staying disciplined with retirement savings deposits can be challenging. Fortunately, most banks and financial institutions allow you to automate deposits into other accounts. So, you can set your bank account to contribute to your IRA or other account every month without further effort on your part. This way, you’ll stay on track to maximize your contributions and boost account growth.

Explore other alternatives

Here are some additional beneficial alternatives to a 401(k).

- SEP IRAs, SIMPLE IRAs, and Individual 401(k)s are available for self-employed workers and small business owners. These alternatives allow you to increase your annual retirement contributions, and the setup is uncomplicated. Plus, they offer higher contribution limits.

- If you have a high-deductible health plan, you may be eligible for a Health Savings Account (HSA) if your plan has a high annual deductible (e.g., $1,500 for individuals and $3,000 for families in 2023). Like an IRA, an HSA enables you to make tax-deductible annual contributions. Plus, withdrawals from the account are tax-free.

- Some states have introduced retirement programs to facilitate savings for workers. These programs include auto-IRAs, retirement marketplaces, and multi-employer plans. Auto-IRAs regulations require employers not offering a 401(k) to automatically enroll their employees in a Roth IRA and deduct contributions from their paychecks, similar to a 401(k). Workers can cancel the plan after being enrolled if they so choose. Some programs are entirely voluntary for employees. If your workplace doesn't offer a retirement plan, it is worth exploring the type of retirement savings program your state may provide.