Life's unexpected twists and turns can threaten financial stability among even the highest-earning households. Experts advocate for emergency funds because they act as a financial fortress protecting you from sudden job loss, unforeseen medical emergencies, and more.

Read on to learn about a savings target for your emergency fund, the optimal account choices, and five strategies that can fortify your financial security and empower you to face the future with confidence.

How much money do you need in an emergency fund?

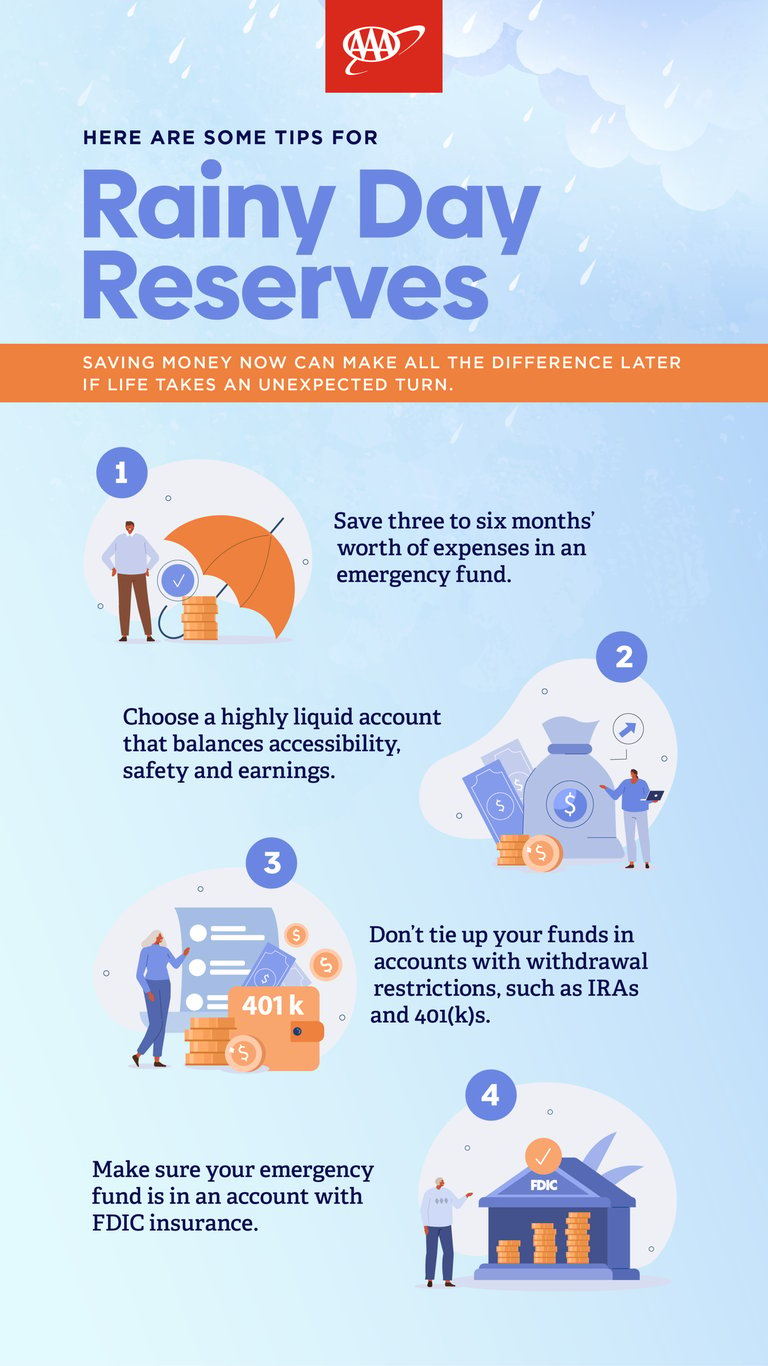

Experts recommend saving three to six months' worth of expenses for an emergency fund for numerous reasons:

- Income Stability and Job Loss—In the event of a job loss or unexpected reduction in income, an emergency fund provides a financial cushion. It can cover your basic living expenses while you search for a new job or address the situation.

- Unforeseen Expenses—Emergencies can come in various forms, such as medical expenses, car repairs, or home repairs. An emergency fund ensures you can cover these surprises without using credit cards or loans.

- Peace of Mind—Knowing you have a financial safety net provides peace of mind. This benefit reduces stress and anxiety because you have a cushion for unexpected setbacks.

- Avoiding Debt—Credit cards are often a go-to option for households without an emergency fund. Unfortunately, credit cards can have interest rates of 20%, which is burdensome in the long run.

- Economic Downturns or Recession—Job security can be uncertain during economic downturns. An emergency fund gives you a buffer until things improve.

- Medical Emergencies—Health care costs can be substantial, even with insurance. An emergency fund can help cover deductibles, co-pays, and other out-of-pocket expenses.

- Sudden Life Changes—Events like divorce, the death of a family member, and natural disasters can bring about unexpected expenses. An emergency fund can provide financial security in these challenging situations.

- Flexibility and Decision-making Power—An emergency fund gives you more flexibility in making important life decisions. You may be more confident in pursuing new job opportunities or starting a business.

- Avoiding Liquidation of Investments—In times of crisis, you might be tempted to sell investments at a loss to cover immediate expenses. An emergency fund can prevent this, allowing you to keep your investments intact and benefit from future market growth.

Ultimately, the three-to-six month guideline balances having enough to cover a range of emergencies while not tying up too much of your money in a low-yield savings account. Remember, you can adjust this guideline to match your circumstances and risk tolerance.

Where should you keep your emergency fund?

When deciding where to keep your emergency savings, it's essential to choose an account that balances accessibility, safety, and earnings. Therefore, a highly liquid, secure account is suitable.

For example, a savings account is a popular choice for emergency money because you can quickly access the funds. However, these accounts bear minimal interest. Shopping around for a bank, credit union, or online institution can help you get the best interest rate.

Second, a money market account is a type of savings account that offers higher interest rates than standard accounts. These accounts usually impose minimum deposit and balance requirements. As a result, this option may be inaccessible if you don't have several thousand dollars to deposit into your emergency fund immediately.

High-yield checking accounts are the most lucrative option because they offer better interest rates. However, like money market accounts, they typically have balance, deposit, or transaction requirements that can prevent you from opening an account or incurring fees if you don't fulfill your obligations.

Remember, the primary goal of your emergency fund is accessibility. Avoid tying up your emergency funds in investments or accounts with significant withdrawal restrictions, such as IRAs and 401(k)s. Additionally, it's critical that the account you choose has FDIC insurance. This government-sponsored free protection guarantees accounts up to $250,000 at financial institutions that fail. This way, your emergency fund won't vanish if your bank or credit union goes belly-up.

What’s considered an emergency?

Your emergency fund covers unexpected expenses and financial challenges. It serves as a safety net when your checking account isn't sufficient. Here are common scenarios your emergency fund can help with:

- Income or job loss

- Medical emergencies, temporary disability, or illness

- Car or home repairs

- Travel emergencies

- Legal Fees or unexpected taxes

- Pet emergencies

- Natural disasters

How to boost your emergency fund

Here are five strategies for maintaining an emergency fund:

1. Create a budget

Creating a budget is a foundational step in effective financial management. It involves tracking your income and expenses to understand where your money is going. A budget will categorize your expenses into essentials (like rent, utilities, and groceries) and non-essentials (like dining out and entertainment). By doing so, you can identify areas where you can cut back and redirect that money toward your emergency fund.

2. Deposit windfalls

Use unexpected or irregular sources of income to jump-start your emergency fund. For example, tax refunds, work bonuses, and gifts can quickly strengthen your account without impacting your budget.

3. Take on a second job

Taking on a second job or gig work increases your income and expedites your efforts, as it enables you to dedicate extra funds solely towards your emergency fund. Investing five to ten hours per week can generate hundreds of dollars a month for your account.

4. Automate your savings

Automating your savings involves setting up automatic transfers from your checking account to your designated savings account. Doing so ensures a consistent and disciplined approach to saving. This way, you treat savings as a non-negotiable expense, just like rent or groceries.

5. Set incremental savings goals

Instead of aiming to save your entire emergency fund at once, break it down into smaller, achievable goals. This approach makes the task less overwhelming and provides a sense of accomplishment as you hit each milestone. For example, if your goal is $6,000 for a six-month emergency fund, you might set incremental goals of saving $500 each month for one year.