Putting your finances on auto pilot can help you better manage your money and budget. This is especially true if you find yourself making late payments or forgetting to contribute to your savings account. Setting up auto-pay takes some of the guesswork out of managing your finances so you don’t have to worry about missing payments. So, if you’re curious about pre-planning your finances, here are some bills you should (and should never) put on auto-pay.

What bills should you automate?

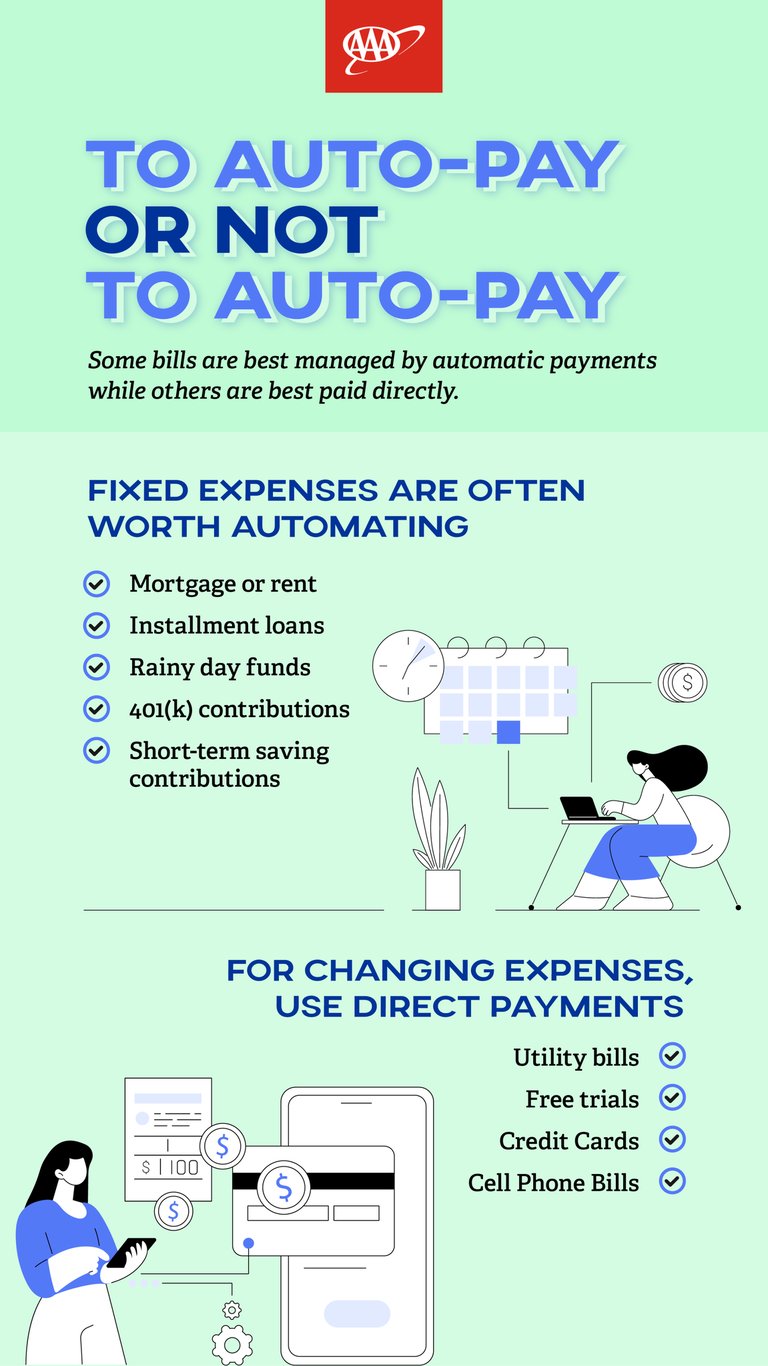

You can set most of your payments on auto pilot by setting up auto-pay. However, auto-pay usually works best for fixed expenses that don’t change throughout the year. Therefore, some expenses worth automating include:

- Mortgage or rent

- Installment loans

- Short-term saving contributions

- 401(k) or employer-sponsored plan contributions

- Rainy day fund contributions

Keep in mind, even if you set up these payments for auto-pay, you can still make additional payments if necessary. For example, if you set up auto contributions for your savings account but get a bonus and want to contribute more, you could schedule an extra contribution.

What bills should you never have on auto-pay?

While auto-pay is a great way to save time and avoid late fees and penalties, it doesn’t necessarily work for every expense. With this in mind, here are some bills you may want to pay directly.

Utility Bills.

Likely, your utility bills such as heat and water will fluctuate every month. So, it might be better to review your bill every month and pay it directly. This way, you can spot any errors and ensure all fees are correct.

Free Trials.

How many times have you signed up for a free trial and then forgotten to cancel it? If you’re like other consumers, this situation has probably happened many times. Therefore, avoid setting up free trials for services on auto-pay, so you’re not charged for services you no longer use. Instead, set a calendar reminder a few days before the free trial ends. This way, you can make sure you’re actually using the service and it’s something you want to spend your money on.

Credit Cards.

Setting up auto-pay for your credit card could be problematic. It’s important to always make your minimum monthly payment. However, if you use your credit card on a regular basis, your minimum payment can fluctuate, which may make it a budgeting challenge. Additionally, you don’t want to get into the habit of not reviewing your credit card statement every month. Reviewing your statement helps you pinpoint fraud or other unauthorized charges that may go unnoticed if you set your credit card up for auto-pay.

Additionally, not monitoring your credit card spending could wreak havoc on your finances if you’re not careful.

Cell Phone Bill.

While some folks have a cell phone bill that never changes, others may have fluctuating charges. So, if your data usage varies from month to month, setting up auto-pay might not be the best solution. This is because cell phone companies don’t bill on the same date each month. Even if you are set to pay on the same day every month, the billing cycle could’ve shifted slightly. Therefore, the number of days on your bill and data usage can fluctuate. This causes your bill to increase or decrease.

If you aren’t checking your bill every month and you’re charged more than usual, unexpected additional funds could cause your account to overdraft, which in turn, could result in additional bank fees. Don’t get in a situation where a payment you aren’t expecting posts, leaving you with possible stress trying to find the extra funds.