What You Need to Know to Improve Your Credit

Debt payments, holding on to credit, and more

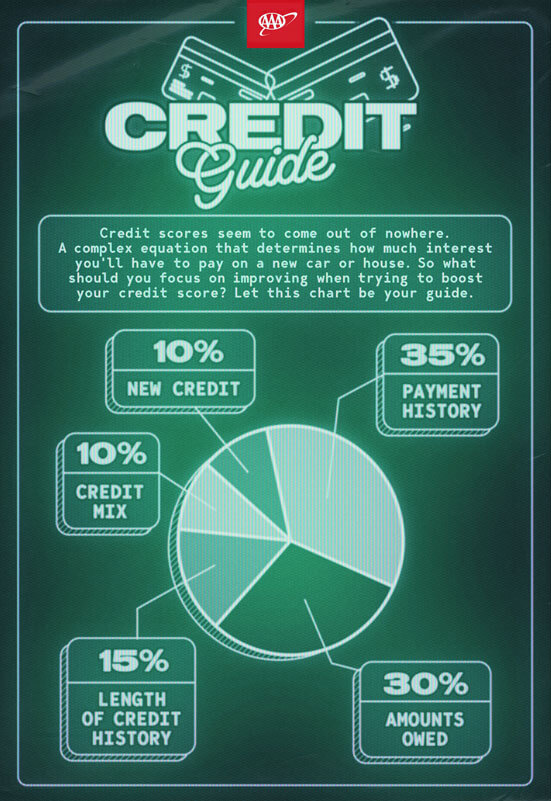

Multiple factors go into your credit score, but some have a bigger impact than others. For example, when it comes to your FICO score, there are five categories: Payment History (35%), Amounts Owed (30%), Length of Credit History (15%), Credit Mix (10%), and New Credit (10%).

While there are multiple versions of the FICO and other credit scores, most rely on similar factors. So, you can improve your credit score across the board with certain measures. Use these steps as a quick guideline to put you back on the right financial path.

Avoid Late Payments

As you can see, payment history plays the biggest role in your score. Because of this, your score can take a significant hit if you fall behind on payments. Even just a few days behind may result in points dropping.

But keeping track of every single bill or charge can be hard. Switching to automatic payments helps if you have trouble with organization or budgeting.

If you can’t avoid a late payment, try contacting your lender as soon as possible. They might be lenient if you have a good track record or if you have a hardship, such as job loss.

Pay Down Debt

Your credit utilization is also a significant factor in your score, which includes debt you owe. Improve it by paying down your revolving debt or debt owed against any credit line.

You may have multiple debts with various interest rates, making it hard to repay them all. For some, it may be worthwhile to consolidate your debt. You might take a temporary hit to your score, but sticking to your repayment schedule will bring it back up.

Pay More Than the Minimum

Paying down debt is always a great step for improving your credit. But it can be a slow process if you only pay the bare minimum. Opting to add a little extra to each payment helps reduce your overall debt quicker.

You can also pay more frequently if that schedule works better for you. Although, in some cases, you may need to talk to your lender or creditor first.

Hold on to Credit

The overall age of your credit history actually matters. The longer yours is, the better it looks. As a result, you want to avoid closing older credit accounts.

In the same vein, you might want to hold off on getting any new accounts or credit. When you submit a credit application, it can lead to a hard inquiry. Hard inquiries have the potential to hurt your score, especially if they add up. If you need a strong credit score for a big purchase or loan, just wait to open new credit until after.

Reduce Your Credit Utilization

You have a certain amount of credit available to you. Your credit utilization rate is essentially the amount of credit you currently use divided by that amount. For example, if you have a total card limit of $15,000 and use $3,000, then your credit utilization is 20%.

According to Experian, a major credit bureau, you want to avoid using more than 30% of your overall credit limit at once. And you should pay off your credit balance from month to month.

Check for Inaccuracies

Sometimes, a credit report contains inaccurate information. Not all of these errors will hurt you, like typos on your address or personal details. But a mistakenly reported late payment could.

If you find any issues, file a dispute with the credit bureaus. They generally have to address disputes within 30 days of filing. You can contact them directly at:

- Experian: Experian.com/disputes

- Equifax: Equifax.com/personal/disputes

- TransUnion: Transunion.com/credit-disputes/dispute-your-credit

Remember, you can access one free credit report every year from each agency through AnnualCreditReport.com. You can also find a (sometimes free) credit monitoring service to track how your score changes over time, helping you identify any unexpected drops or potential fraud.