A car is a big and expensive purchase, with an average price of around $47,000. But the sticker price is just part of the total cost. Interest rates can significantly impact whether your car purchase is smart, adding hundreds or thousands of dollars to the total price. Since rates and terms vary, it's essential to research and shop around to find an auto loan with competitive terms. Here are some tips to help you find the best auto loan rates.

WHAT IS A GOOD AUTO LOAN RATE?

Before diving into auto loan shopping, knowing what a good rate looks like can be helpful. A good rate in 2024 might be very different from what it was 5 years ago or what it will be in the future. This fluctuation is often due to inflation in the U.S. economy and other factors, such as:

- Your credit score

- Your debt-to-income ratio

- Make and model of the vehicle

- Current federal funds rate

- Loan amount

- Length of loan term

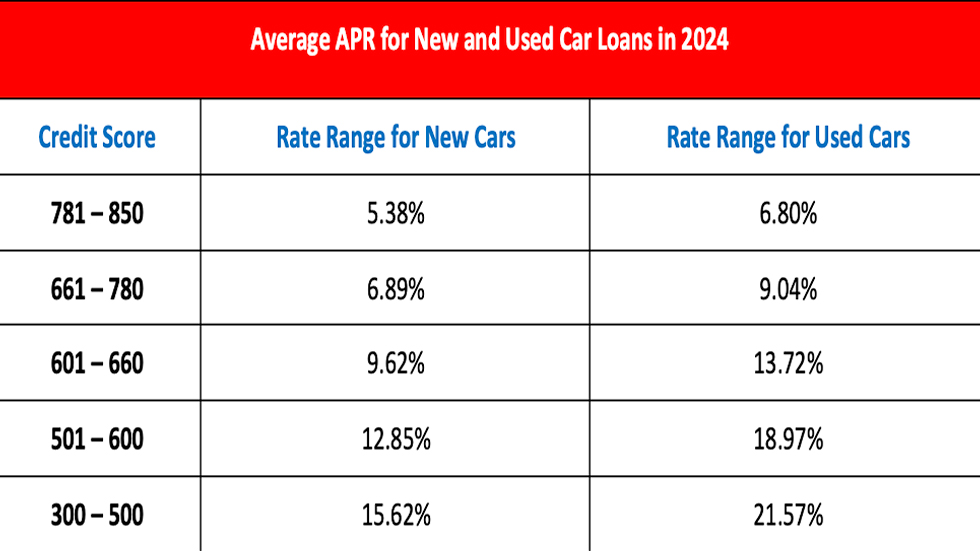

Your credit score plays a big part in determining your interest rate, so it's crucial to consider it when making a car loan decision. To give you an idea of what to expect, here are the average auto loan rates based on different credit scores, according to data from Experian.

Source: Experian

Source: Experian

HOW TO FIND THE BEST AUTO LOAN RATES

To lock in a great auto loan rate, take your time to research and prepare thoroughly. While you can't control the rates offered, there are steps you can take to improve your chances of finding the best auto loan rates.

REVIEW YOUR CREDIT SCORE AND CREATE A BUDGET

Your credit score is crucial for determining your interest rate, so checking it before applying for a car loan is a must. You can check your credit score for free at AnnualCreditReport.com.

You can usually qualify for the most competitive auto loan rates with excellent credit scores above 780. While auto lenders typically require a credit score of at least 600, it's possible to qualify for financing with a score as low as 500, though you may face higher rates.

If your credit score needs some improvement, try these steps before applying for a loan:

- Check your credit report for inaccuracies

- Pay your bills on time

- Pay down existing debt

- Catch up on past-due accounts

- Avoid applying for new credit, like opening a new credit card

This is also a great time to review your budget and decide what monthly payment you can afford. Be sure to factor in gas, regular maintenance, and auto insurance costs.

COMPARE AUTO LENDERS

You have 2 main options for financing your vehicle, each with its pros and cons:

- Dealer-Arranged Financing: This option involves a middleman—the car dealer. It's more convenient, but you'll usually pay more because the dealer adds interest to handle the financing.

- Bank, Credit Union, and Online Financing: Going directly to a bank, credit union, or online lender helps you avoids dealer fees. Some lenders may offer better rates to their established customers, though you're not limited to lenders you already have a relationship with.

Many auto lenders offer pre-approval, which helps you lock in a rate before you head to the dealership. It's best to gather at least 3 offers to compare and find the best deal.

When comparing your options, look beyond just the interest rate. Consider the loan length, the vehicle's initial cost, and the monthly payment. This way, you can compare the total cost and identify the most affordable option.

REDUCE THE REPAYMENT TERM

Opting for a lower monthly payment might seem easier each month, but it can end up costing you more in interest over the loan's duration. Choosing a shorter repayment term reduces the years of accruing interest, saving you money in the long run.

The difference isn't slight either—it can amount to thousands of dollars between a 3-year and a 6-year car loan. Additionally, a shorter repayment term could also mean a lower Annual Percentage Rate (APR), although this varies depending on the lender.

INCREASE THE AMOUNT YOU PUT DOWN

Your interest rate directly reflects how trustworthy auto lenders perceive you to be. One effective way to demonstrate your reliability is by making a larger down payment. This shows that you're committed and less likely to walk away, leaving the lender with unpaid debts.

An excellent guideline to show you're a low-risk borrower is to put down 20% of the purchase price for a new car or 10% if used. A solid down payment demonstrates you're financially stable and committed to the loan.

CONSIDER A CO-SIGNER

If your credit score is lower, 1 option to secure a lower rate on your auto loan is to consider a co-signer with a better credit score. This strategy works best when the co-signer has a higher credit score than you.

However, finding a co-signer can be challenging because it puts them at risk if they miss payments, which could also negatively impact their credit score. Co-signing is usually considered a last resort because of the potential strain and consequences it can create if you're unable to secure the desired rate independently.