The Important Difference Between Annuities and Life Insurance

How they differ and what they offer

Life Insurance vs. Annuities: Understanding the Differences

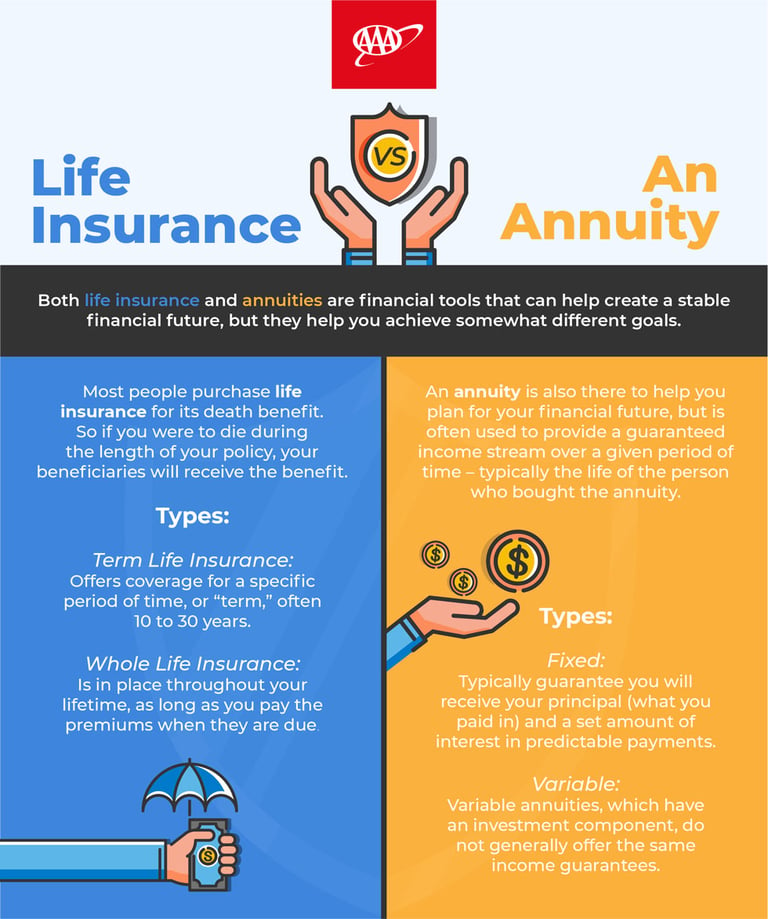

Both life insurance and annuities are financial tools that help create a stable financial future, but they serve different purposes.

Most people purchase life insurance for its death benefit. If you pass away during the policy term, your beneficiaries receive the payout. This ensures that your loved ones are financially secure in your absence.

What is Life Insurance?

Life insurance is often purchased when financial needs are high and savings are limited—this is common for young couples, new parents, and families with growing expenses.

There are several types of life insurance:

- Term Life Insurance – Provides coverage for a set period (10-30 years). If you pass away during this term, your beneficiaries receive the payout.

- Whole Life Insurance – Provides lifelong coverage as long as premiums are paid. It includes a cash value component that policyholders can borrow against for expenses such as college tuition, home purchases, or business investments.

In most cases, the death benefit for term and permanent life insurance is tax-free.*

What is an Annuity?

An annuity is a financial tool designed to provide a guaranteed income stream over time—typically for the remainder of the policyholder's life. It is often used in retirement planning to ensure steady income.

There are two main types of annuities:

- Fixed Annuities: Guarantee the return of principal (your initial investment) plus a set amount of interest. Payments are predictable and stable.

- Variable Annuities: Invest funds in equities markets, meaning returns fluctuate based on market performance. These offer higher potential gains but also come with risk.

Some annuities may also include a death benefit, which pays a predetermined amount to a beneficiary upon the policyholder’s passing.

The Bottom Line

Both life insurance and annuities offer significant financial benefits, but they serve different purposes. While life insurance provides financial security for your loved ones, annuities help ensure you have a steady income during retirement. One does not replace the other, and both may play a role in a comprehensive financial plan.

Speaking with an insurance professional can help you determine which option—or combination of options—is best for your specific financial situation.

*AAA Life and its agents do not provide legal or tax advice. Therefore, you may wish to consult independent legal, tax, or financial professionals before purchasing a policy.