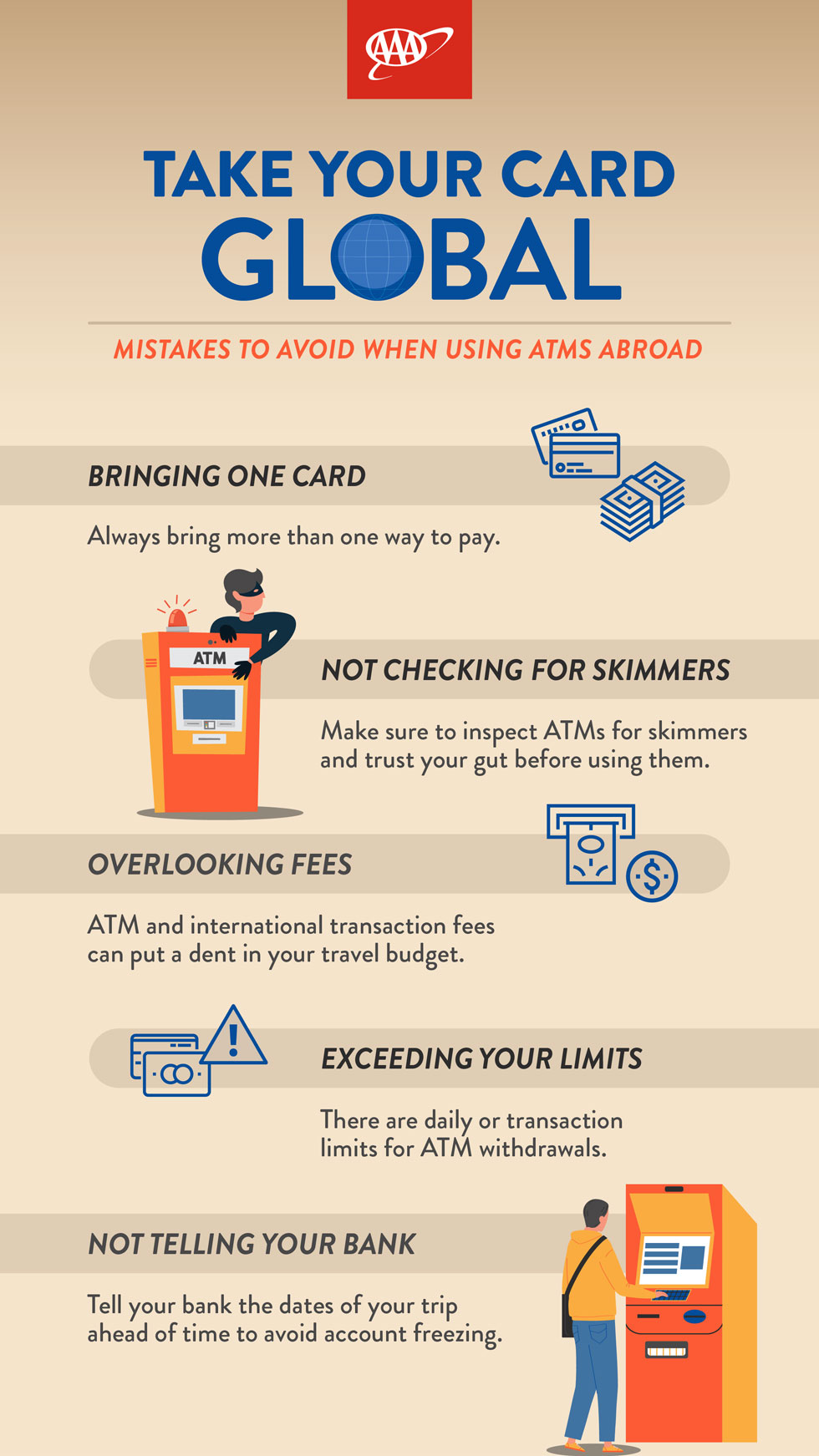

Even if you carefully budgeted for your international trip, you may spend more than anticipated or need a little extra cash. ATMs are incredibly convenient and have become more widely available internationally. However, there are certain mistakes you’ll want to avoid when planning to use ATMs overseas.

Only relying on one credit card

Having more than one way to pay for things while traveling is wise. For example, sometimes a card won't work, or it can be lost or stolen. In these cases, you'll want an alternative payment solution, such as an extra credit card. Also, technology can work differently in different countries, which could lead to issues like your card being unexpectedly declined.

Therefore, it's best to travel with at least one bank card, one credit card, and some cash.

Forgetting to check the ATM

Before inserting your card into any ATM, inspect the card slot and make sure it hasn’t been tampered with or altered. The last thing you need is to have your ATM card cloned, especially when traveling abroad. If you suspect anything is amiss with the ATM, listen to your gut and find another one.

Neglecting to make a copy of your ATM card

Before you leave for your trip, make a copy of your ATM card. It's best to safely store a digital copy instead of carrying a paper copy. Keeping a digital record of your ATM card can be a lifesaver, should your card get lost, stolen, or sucked into an ATM. Plus, if anything does happen, having a digital copy of your ATM card enables you to quickly cancel it.

Disregarding your bank's ATM fees

Usually, ATMs notify you when you’re about to incur transaction fees. However, some don’t give you a warning. That said, it’s important to understand any transaction fees that apply while traveling abroad.

Some banks charge you a fixed transaction fee, while others charge a percentage of your transaction or a combination of both. Also, you may encounter fees for foreign currency conversion, which is usually 2.5% – 3% of the transaction.

If you’re not careful, the international transaction fees associated with ATMs abroad can quickly put a dent in your travel budget.

Exceeding your daily ATM withdrawal limits

Many banks and credit unions have daily limits for ATM withdrawals. Some may even have a limit per transaction. ATM limits typically range between $300 – $1,000 during a 24-hour period. However, the exact ATM withdrawal limit varies by bank or credit union. Exceeding this limit may result in a frozen account, so make sure you know your limits before you travel.

A good rule of thumb is to set a low daily limit with your bank or credit union. This way, if someone get a hold of your ATM card and PIN, they can only withdraw a limited amount of funds.

Not telling your bank about the trip

Banks and credit unions don’t hesitate to freeze your account if they detect fraudulent or suspicious activity. For example, attempting to withdraw cash from an ATM in a foreign country is a significant red flag and could result in a frozen account.

Before your trip, contact your bank or credit union via phone, online, or in person, and let them know where and when you're traveling overseas. Doing so prevents foreign financial transactions from causing alarms or suspensions on your accounts.

Forgetting to set up bank notification

Most banks and credit unions let you set up account alerts for certain activities, like spending over a specific amount. So, before you travel, sign up to receive withdrawal notifications. This way, you’ll immediately know if any fraudulent activity occurs, and you can keep an eye on how much you are withdrawing.

Not counting your ATM withdrawal

While it’s often not convenient or efficient to count your money after using an ATM, getting shortchanged occurs more often than you’d think. Therefore, it’s best to be safe and discreetly check to ensure you received the amount you withdrew. This way, you can address any issues immediately.

Avoid these mistakes when using ATMs during your international travel and you’ll be less likely to end up in an unpleasant and stressful financial situation.