Saving money doesn’t always have to be a challenge. There are plenty of ways you can save money without making a huge sacrifice. So, whether you need extra cash for your dream vacation or you want to build up your retirement savings, here are a few ways you can cut back on your bills without even trying.

BUYING GENERIC

Even if you’re loyal to one brand, you may discover that you don’t see a huge difference when you try a genic product versus your favorite brand’s product. The biggest difference between two similar products is often marketing. Usually, generic brands are a lot less expensive than their counterpart brands. To save some cash, try switching to generic brands.

UNSUBSCRIBING FROM EMAIL NEWSLETTERS

If you love shopping, you most likely receive email newsletters from all your favorite brands. These newsletters are designed to entice you to shop. So, to avoid the temptation of shopping with your favorite brands, it’s wise to unsubscribe from email lists.

REDUCING ENERGY COSTS

From turning off the lights to installing a programmable thermostat, there are plenty of ways to cut back on your energy bill. To help you identify ways to save on your home’s energy bill you can either have a professional complete an energy efficiency audit or you can complete a self-assessment. Either way, you’ll discover plenty of ways to slash your energy bill.

PACKING A LUNCH OR EATING AT HOME

Instead of eating out, take the time to make some simple and fast meals for the week. By taking the time to meal prep a few hours a week, you can save on your eating out costs.

WRITE A LIST BEFORE GOING TO THE GROCERY STORE

If you’ve ever been grocery shopping without a list, you probably have purchased stuff you didn’t need, especially if you were hungry. You may have even bought items you already had without even knowing it. That said, before you head to the grocery store, take an inventory of everything you have, create a menu for the week, and make a grocery list based on what you plan to cook.

This way you can ensure nothing is going to waste and you aren’t spending money on items you don’t need.

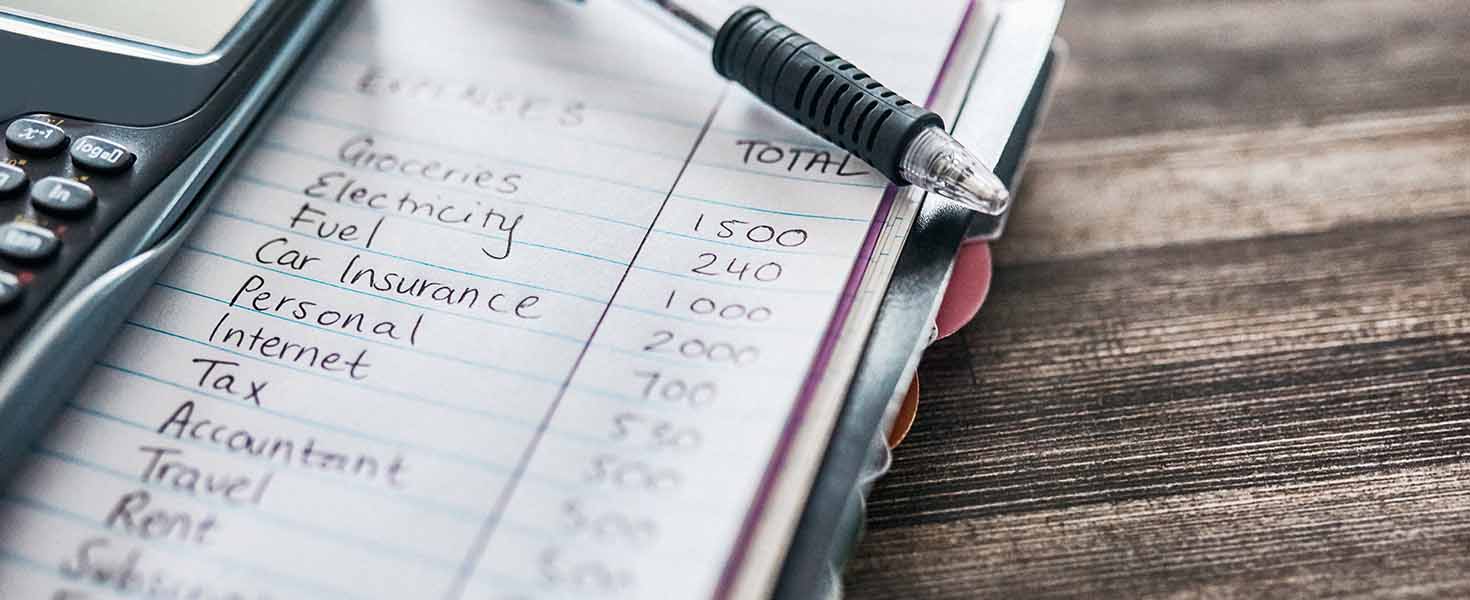

TRACK YOUR SPENDING AND MONITOR YOUR BUDGET

Do you know where your money is going every month? If you’re like many other Americans, you’re probably not tracking your spending habits. To help track your spending, try using a budgeting app like Mint or YNAB. Using a budgeting app can help you monitor and track where your money is going.

USE BILL-SLASHING APPS

Apps such as Rocket Money, BillCutter, and Trim help you monitor your monthly charges and negotiate savings on your monthly bills on your behalf. These apps can also help you cancel your unwanted subscriptions. Therefore, if you want to slash your bills without a second thought, you should consider using one of these services. But, keep in mind, that if they save you money, they will get a portion of your savings.

SET UP SPENDING RULES

Whether or not you have a budget, you can set spending rules for yourself to help cut back on your spending. For example, if you love getting coffee each morning, you can set a rule for yourself that you only treat yourself to an expensive coffee once per week. Another rule might be that you only use cash for purchases, and when you’re out of cash for the week, you don’t spend money until you receive your next paycheck. Saying, “No” to impulse buys is much easier when you’ve set up rules for yourself.

AUTOMATE YOUR SAVINGS

Saving money is much easier when you don’t have to think about it. Therefore, if you receive a direct deposit, you can set up a second account to automatically put a portion of your paycheck into a savings account. Additionally, if your employer offers a matching retirement plan such as a 401(k), you can automatically contribute a portion of each paycheck to this plan.

LEVERAGE BANK AND CREDIT CARD REWARDS

Many banks and financial institutions offer credit cards to their customers. These customers can receive rewards from spending money on their cards. For example, some banks give cashback on all purchases, and others have a points system that allows users to cash in their points for travel rewards or cash. Using these rewards systems can help you pay off their balances each month or cut back on spending in other areas.